X users are from Mars, Bluesky users are from Venus

Bluesky hits 16m users with daily record of 1m new users

Around twenty years ago Elon Musk told the world he was going to take us to Mars so let’s call his clan the people from Mars. Anyway, if you were to say which platform has more overt displays of excess testosterone it would be X and not Bluesky!

Bluesky grows

Progressives and many centrists have flocked to Bluesky. At the same time, following a terrible run of declining user engagement and advertising revenues, X is back. Musk helped win the US elections and X was crucial to this. Advertisers are likely to be heading back albeit slowly. It was a better barometer of sentiment than most media outlets and pollsters.

A friend of mine who is a journalist at Bloomberg sent me an invite code to Bluesky late last year. Fed up with the ridiculous clickbait, bots, and toxic flow that was drowning out relevant content on X I joined Bluesky. But like a party you get to on time but assume the cool people are just running late it was empty. No toxic flow but not much of anything. X may be a nightclub full of people with too much make-up on, stumbling around drunk and now popping Musk pills but Bluesky hasn’t been the Waterstones I was hoping for. More like an empty community hall. That is until this week.

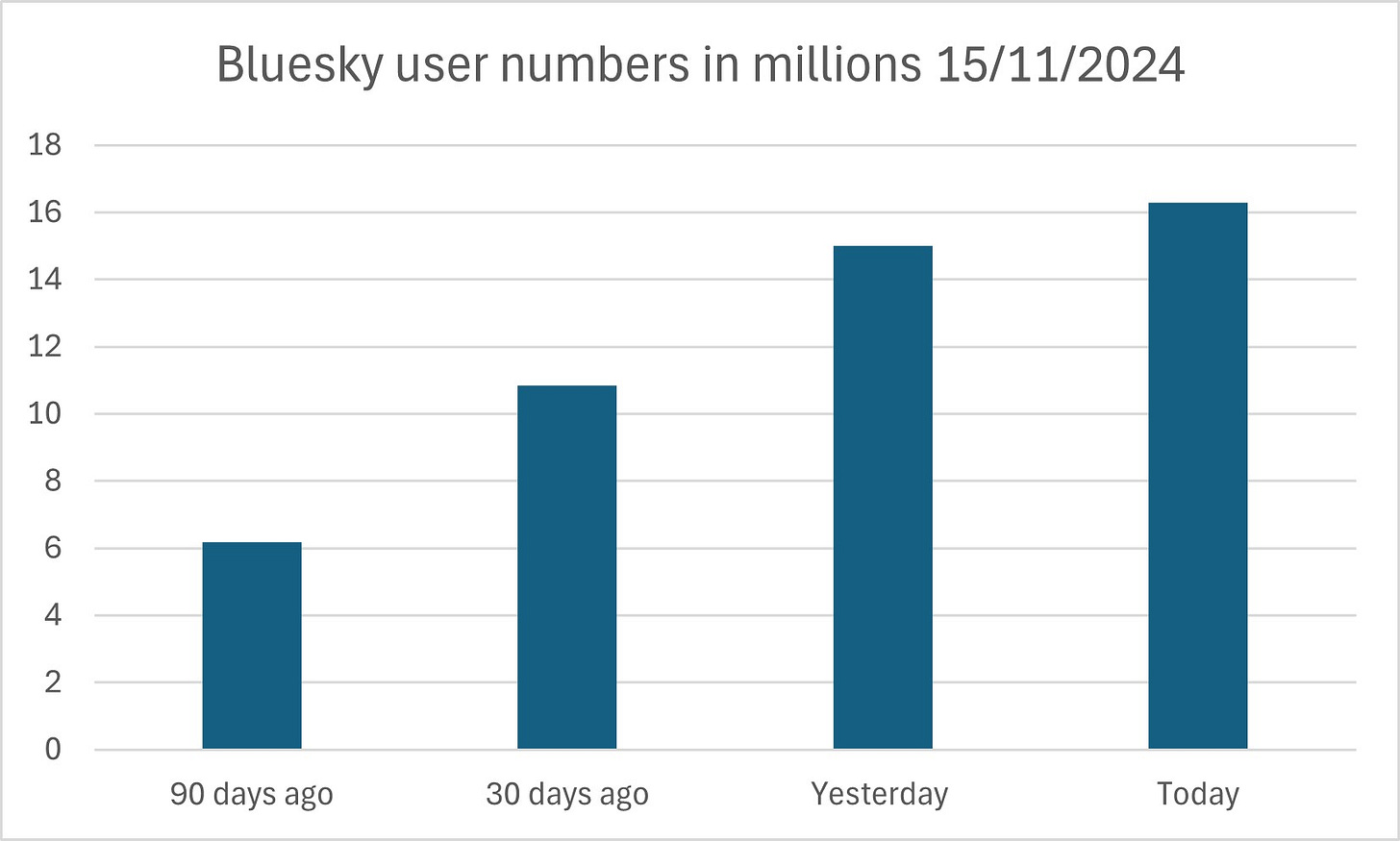

Momentum has been building for a few months. X was banned from Brazil for a while. Musk tweeted about the UK being at Civil War. X stopped you from being able to block people. And finally, the US Presidential elections turned up the decibels on the Musk echo chamber. Bluesky added one million new users a week and hit 15 million users. Then it added one million new users in a day and went over 16 million users. It is the Number One App in the Apple App Store. In the US and UK, it is building real momentum for the first time. Meta’s Threads platform has also seen huge growth.

But here’s the thing. The right is more active than ever on X and so are the venture capitalists and tech community. X remains truly global. Many users will use both platforms. Will there be millions of users deactivating their X accounts or stop posting there?

One major account that made a splashy announcement saying it was going to stop posting on X is the Guardian. Will its top journalists and other major left-wing media outlets follow? For all the moaning by the media about fake news on social media, the bigger reason for not posting on X should be economics. Since all major social media platforms (except for Bluesky) have actively suppressed hyperlinks the percentage of traffic that the websites of major media outlets get from social media has become tiny, typically less than 1.5% from any one site and less than 5% in total.

There are secondary factors to consider. There is the halo effect of brand building. But if media outlets are strong at getting scoops, breaking news, and doing valuable analysis they will still be copied and pasted onto social media. Seeing what is going on in different platforms gives us perspective - the feedback loop and echo chamber are different on LinkedIn relative to X and Bluesky will be similarly different. Feedback loops in the online world are instant and viral but are often not a substitute for real life. What percentage of your friends, colleagues, and family were daily users of Twitter even during its golden years when progressives, academics, and the media were in love with the platform?

How often do you pick up a new book to read based on social media remarks versus a recommendation by a friend or trusted acquaintance? The latter combined with my curiosity is the dominant source for me.

The rise of fragmentation

Which brings me to a thesis I shared a while back. Is social media heading from aggregation to fragmentation just like financial markets?

Peter Thiel in Zero to One talked about the escape velocity that platform business models reach but look at how quickly large X users have been able to reproduce their tens of thousands of followers on Bluesky and you wonder about this.

Technology, product innovation, regulation, and consumer taste led to increased fragmentation of financial markets. New ways to trade became technologically possible allowing market participants to receive more tailored pricing and service. Existing exchanges and trading platforms had the problem of toxic flow and a lack of market depth.

When electronic trading emerged, there were dominant exchanges and exchange-like central marketplaces known as central limit order books (CLOBs) in markets that don’t trade on exchanges like US Treasuries and foreign exchange. The cost of technology came down massively allowing space for competing platforms using the same format (CLOBs) or new formats. In markets that are less liquid a format called Request for Quote (RFQ), where a client would request a certain market maker bank to offer a price for a certain quantity of a stock or bond or derivatives emerged.

One of the major technology shifts was that RFQ which initially had been mimicking manual phone trading started to build out functionality that gave clients many of the advantages of the central marketplace (CLOBs). You were able to send an RFQ to multiple liquidity providers at the same time rather than just one. You were able to show part of your order and hide the rest to limit market impact. Rather than receive periodic RFQs you were able to get prices continuously streamed to you but still tailored just for you. Some platforms offered functionality that allowed market participants to be anonymous to each other on any given trade, but you would pre-approve the list of banks or asset managers that you were willing to trade with.

As we have migrated to an online world the number of ways to share content continues to increase. I am writing this newsletter from the website of Substack, which is arguably another format. Progressives are excited about the idea that Bluesky could be an X killer but actually what we are seeing is fragmentation just like financial market structure.

The fragmentation of social media is not just about the absolute number of platforms but more overlap between platforms. Instagram used to be for holiday photos, Facebook for friends and family, LinkedIn for job updates, and Twitter/X for news and content. But LinkedIn has changed massively in recent years. It is still not strong for real-time news but for sharing content is arguably more powerful than X now.

One of the ways to reduce friction on joining Bluesky in recent days has been “starter packs” where large users have collated and circulated long lists of accounts to follow in specific areas - so there is a fintech list, FT journalists list, and so forth. At some point, we will be able to carry our “lists of friends and followers” from one social media platform to another in a more portable fashion.

In financial markets, the way that market participants deal with fragmentation across multiple platforms is aggregators. This is software aggregating prices from across a plethora of platforms and provides tools and functionality on top.

The aggregator for a lot of online content was Google Search but just like social media platforms Google Search is increasingly plagued by quality issues that are making their results less effective. A Generative AI era will be more fragmented as Google Search is challenged by OpenAI and others.

Will more content be distributed privately?

In financial markets, a major trend has been internalization. Rather than trade on exchanges and other platforms, large market makers increasingly match buyers and sellers in-house without having to offset every trade externally. What has made this possible is huge scale, better data, and technology. When there was a bank run on Silicon Valley Bank the joke was that all its customers (tech/VC) were on the same WhatsApp group. Similarly, many of the most valuable conversations in tech are no longer happening on X but are in WhatsApp chat groups. Private forums have always existed in other industries. For instance, a forum that became the butt of many jokes on Wall Street was the hedge fund ideas dinner.

The problem of toxic flow

People have been distorting financial markets for centuries in the form of price manipulation, circular/wash trades, collusion/information sharing, insider information, reference price manipulation, front-running, and misleading customers. But things have got faster. One example is “spoofing” where a trader moves the price of a financial instrument up or down by placing a large buy or sell order with no intention of executing it, hence creating a mirage of market interest. Once the price has moved the trader cancels the original order and places a new one. Electronic exchanges saw a massive spike in this. JP Morgan received a huge $920m fine in 2020 for spoofing on its metals and treasuries trading desks between 2008 and 2016. Spoofing is industrialized using algorithms.

Social media face the same pressures of toxic flow. How many anonymous accounts on X are just people with regular jobs who do not want their colleagues watching over their shoulders versus bots, click farms, fake accounts, and trolls? AI will increase the amount of copying and faking. I was listening to a fascinating The Verge/Decoder podcast with Brian Chesky the other day and he said, “I emailed Elon when he acquired Twitter and said he should verify 100% of the users and that they are real.” Chesky said before moderating content you should moderate people and check every account even the anonymous ones. Musk of course went the other way on account and content checking.

The problem of recycling and market depth

Most trading volumes on exchanges come from high-frequency trading (HFT) firms that don’t take significant balance sheet risk and even banks are increasingly in the game of recycling liquidity from one platform to another. This is before we add quantitative hedge funds that look for price signals rather than underlying fundamentals or passive money.

X has recently touted surging daily activity levels, but this reminds me of how exchange volumes would go up massively because of the HFTs and recycling. A 2019 study Accelerating dynamics of collective attention | Nature Communications found that top trending topics on Twitter (now X) had steeper and more frequent peaks; a hashtag only stayed in the global daily top 50 hashtags on the platform for 11.9 hours in 2016 vs. 17.5 hours in 2013 but received much greater attention within that shorter time. I am pretty sure this trend has accelerated further in recent years.

Going back to our analogy with financial markets as well as trading volumes the things market participants worry about are market depth and having uncorrelated flow. A large asset manager or hedge fund may be happy facing off with HFTs and others every day but every so often they will need to conduct a block trade of shares or bonds and there are very few market makers that are able and willing to warehouse that risk for them. Similarly, sell-side trading desks love their big hedge fund clients because of the money they make on the financing side but at the same time they want lots of uncorrelated flow from clients like corporate treasurers that have regular hedging requirements, are less price sensitive and less sophisticated.

To bring it all back to social media platforms this is the challenge for them. A balancing act between activity levels vs content moderation, the high-frequency users, recycling, market depth, and the uncorrelated flow of different opinions or less frequent users.

All roads lead to fragmentation

The experience of financial markets suggests to me that this is all near impossible and more fragmentation is likely when users have choices.

Have really been enjoying the analogy you are exploring.

Do you have a take on Nostr? Promoted as the most fragmented ("Decentralised") of all the social media platform? Not a user myself.

Greatly enjoyed your analogies to financial trading and market structures—fascinating parallels! I left Twitter in mid-2021, well before any talk of a sale, and joined the decentralized Mastodon fediverse; Bluesky as soon as it became available—what can I say? I'm quick to recognize ahead-of-the-curve tech potential. I couldn’t quite find community on Mastodon and quit a month or so ago. I was planning to quit Bluesky too, as it also felt like an empty party, but this weekend's momentum shift is palpable and those “starter packs” are already making waves!

Your point on fragmentation resonates deeply: like alternative presses, platforms will likely co-exist in a complex ecosystem. Recently, I’ve been defending Substack on a professional community forum. Bottom line: until we set clear boundaries between profit-making and the human costs of toxic flow, we’ll continue cycling through new “markets” of information.

The global future of digital information feels less about centralization and more about navigating these fragmenting flows—and, in the words of futurists, learning, unlearning, and relearning. It’s also about understanding our own unique infophilic information lifestyles (love of information and connections) to foster inclusion and turbocharge equity :). Thanks for a thought-provoking read!