The blurring lines between HFTs and hedge funds

Convergence, competition and new business models

Competition is blurring the lines of industry segmentation in finance. Earlier this month Goldman Sachs’ co-head of global banking and markets,” Ashok Varadhan told IFR in a rare interview “As you grow and become more relevant, there are going to be times when your clients will be your competitors, and you just have to manage through that.”

One such example is private credit. Private equity - the clients of banks - turned into competitors in private credit. But the banks still lend to private credit funds, want to distribute their loans, and are starting market making of private credit. They are frenemies.

The business model of proprietary trading firms (PTFs)/high-frequency trading (HFT) firms and hedge funds has evolved considerably. Arbitrage opportunities that were profitable in the past have shrunk. New opportunities are blurring the lines of distinction between the two industries. Many of the firms that are thriving are the ones driving this overlap.

Before digging into this topic let me tell you a story of one related industry where customers became competitors and the distinction between two industry segments became blurred.

EBS - a tale of market structure change

I worked for a company called ICAP. We had thousands of brokers who spoke to traders at banks. We were in highly competitive markets pitting us against Howard Lutnick. Our customers liked us and complained about monopoly exchanges. One of our marque platforms was EBS in FX trading.

When my colleagues acquired EBS in 2006, it was at the nexus of two mega-trends: the emergence of electronic trading and centralized marketplaces. But by the time I joined in 2012, EBS and its peer Reuters Matching had declined from almost half (in 2006) to only 15% of industry spot FX trading volumes.

But what scared us was the outlook. The analogy that comes to mind (albeit not perfect) is Google Search today. A massive deterioration in the quality of the product and user experience in recent years, coupled with the emergence of a substitute in the form of Gen AI offerings is taking a large amount of our time away from Google Search. But Google Search is still delivering huge advertising revenues. Similarly, financial analysts and shareholders couldn’t see what we could see inside ICAP - the market structure had fundamentally changed and volumes and revenues were a lagging indicator.

EBS’s largest customers the big dealer banks had got bigger through market share gains and bank mergers. With this greater flow and new technology, they increased internalization i.e. crossed their client orders in-house. This trend was already there in the pre-GFC years but with revenues hitting record levels owing to macro volatility, EBS management ignored it and chased the fast-growing HFT client base. But that deteriorated the quality of the marketplace even more and soon banks were internalizing 80% of their volumes. Then smaller banks struggling with EBS migrated to being customers of the big bank’s trading platforms.

By 2012 most of this had played out, but volumes hadn’t collapsed completely because we still had a trading arcade. However, it was not fun for HFTs to trade against each other rather with the banks. HFT volumes peaked as latency arbitrage became less profitable and costs of the speed game spiraled. The platform was full of toxic flow and to prevent the banks from setting up a competitor that would have killed off EBS we had to slow it down and put in guard rails. Nevertheless, the banks never really came back to EBS in any great size. The genie had been let out of the bottle, at least on the most liquid FX currency pairs.

The big pie was in connecting banks to their customers. We created our own EBS platform to do this. It got some traction but there were already a dozen other platforms owned by the banks and firms like Bloomberg. They had been in existence for 15 years and had a much wider network of the buy side and corporates. Unlike Google Search taking on the incumbent search engines during the dot com bubble, we didn’t have a 10x tech advantage. In addition, unlike the Internet which was brand new in the early 2000’s, the FX electronic trading platform landscape was extremely mature by 2012.

The reason I tell this story is that the big banks that were our friends crushed our business not by going to a direct competitor but by doing things differently. We suffered from Clayton Christensen’s Innovator’s Dilemma. When we tried to move to the way of the world it was too late, and we didn’t have enough differentiation. Two distinct industry segments – the interbank market and the bank-to-customer market became blurred into one.

Where we were more successful was adjacencies where we could leverage our traditional strengths. We created a highly profitable franchise by migrating Asian emerging market currencies such as the Indian Rupee and the offshore Chinese Renminbi interbank market from voice broking to electronic trading.

Blurring lines between HFTs and hedge funds

Let’s start with a quick definition. The reason I earlier used the term PTFs as well as HFTs, is that there are firms like Jane Street that don’t quite fit into the traditional HFT description.

There are five main ways these two traditionally distinct financial market participants are increasingly overlapping in their business models: the frequency of trading, converging trading strategies, size and duration of capital bases, headcount and infrastructure, and asset class expansion.

Let’s start with the frequency of trading. In the decade following the GFC, there was a 90% decline in the revenues that traditional HFT strategies made by trading on US equity exchanges and exchange-like platforms. There was increased competition, costs, and margin compression in latency arbitrage across not just equities but other markets. Some huge HFT giants like Getco failed to re-invent themselves and became melting ice cubes.

Some of the HFT businesses that flourished were quasi-captive liquidity pools like Citadel Securities’ dominance in off-exchange retail wholesaler flows. There are moats and scale benefits here. Others are trying to copy this. Hudson River Trading (HRT) has increased its market share of US equities from 5% a decade ago to 10% today. Although known for its HFT roots, HRT claimed even a decade ago that it had average holding times of positions of 5 minutes and held 25% of positions overnight rather than being flat overnight. A few years ago, it followed Citadel Securities into the US equity retail wholesaler market. A recent Business Insider article said that HRT generated around $8bn of revenues in 2024 with half of profits coming from its traditional HFT business but “the firm is now earning billions in profits from hedge-fund-style trading strategies that require greater risk and longer holding periods, and a unit dedicated to such strategies called Prism has become a key profit driver.”

Two firms that have been building state-of-the-art computational infrastructure in Iceland recently are XTX, the fastest-growing HFT of recent years, and QRT the fastest-growing quant hedge fund of recent years. They illustrate the convergence of the two industries well. XTX has been a fervent critic of traditional HFT trading strategies that lead to constant recycling of the same liquidity and a negative market impact. XTX from its origins almost a decade ago was willing to hold positions for many minutes and stream prices in larger sizes than most HFTs. In the rates markets Citadel Securities has been able to compete with dealer banks by a similar willingness to warehouse risk and make prices in larger sizes than traditional HFTs.

At the same time hedge fund business models have moved from low-frequency discretionary and systematic trading to more mid-frequency trading. For all that is written about the fundamental research that goes on at pod shops, as well as leverage the main difference between them and other hedge funds is the amount of trading activity – they trade far more stocks and financial instruments with less concentration and much more frequently.

This is even more the case with the multi-strategy quant funds. For instance, Capital Fund Management (CFM), Squarepoint, and QRT that I wrote about recently trade thousands of stocks, futures, and other liquid financial instruments and are traders, not long-term investors. Given the huge amount of daily trading activity these three firms do, execution and market microstructure are more important for them than most other hedge funds.

Big hedge funds have been getting more active in traditional sell-side activities. Citadel has two wholly owned broker-dealer subsidiaries inside its hedge fund and separate from Citadel Securities. QRT has a market-making business leveraging its quant expertise, huge flow, and technology. CFM designs its portfolio allocation around execution. It shuns the sell side and does all its execution in-house.

Secondly, converging trading strategies. The new hedge fund giants whether it be the pod shops or new quant giants are increasingly run by ex-sell side traders. Much of what they do is trading businesses that were pushed out of the banks given tighter regulations, such as treasury basis trading, index rebalancing, or intraday statistical arbitrage.

Although many of the older hedge fund quant funds have been running momentum and mean reversion quant models for decades, what is new is the move towards more short-term models at a time when HFTs are moving towards longer-term models meaning they are increasingly overlapping in mid-frequency strategies. In addition, to the three areas I mentioned earlier, ETF arbitrage has been a big area of overlap. Other areas include macro systematic and relative value albeit different leverage levels in the latter limit overlap.

I have written in the past about the tremendous growth of Jane Street, which has been eating the lunch of the bank market-making desks. But its roots are more medium-frequency PTF and hence it has the largest percentage of its business that competes with hedge funds rather than market makers. For instance, it made $2-3bn in Indian options last year and was involved in a lawsuit against its former traders and their new employer hedge fund Millennium.

One of the older quant hedge funds Two Sigma has a securities business that provides market-making and intraday alpha across equity, futures, and ETF markets. It has built a top 5 retail wholesaling business in US equities and expanded into options trading with the acquisition of Timber Hill.

Third is the size and duration of capital bases. Hedge funds have been looking for more permanent capital. I have written about how the likes of Millennium have been locking in their clients for longer, how founders and senior staff at hedge funds like Citadel are an increasing proportion of fund AUM, and how some of the best hedge funds like BlueCrest have become family offices.

HFTs that were traditionally not taking overnight position risk are running greater inventory and have quickly built up large capital bases equivalent to a major hedge fund’s AUM. The best examples are Jane Street, which has grown its shareholder equity from $3.8bn in 2019 to $30bn in 2024 (with a capital base exceeding $40 billion when factoring in debt), and Citadel Securities which grew its trading capital from $13.5bn at the end of 2023 to $18bn at the end of Q1 2025. But this is an industry trend. HRT has seen its equity base grow from $390m in 2018 to $3.3bn in 2024 and its gross assets grow from $1.3bn to $19.1bn over the same period. Optiver’s equity base has more than trebled in the last 3 years to $5.5bn. IMC has seen a 50% increase in their equity base over the last 2 years to around $1.9bn.

These firms are also looking for other external capital sources. Jane Street, HRT, and Citadel Securities have all raised financing through bond offerings. Citadel Securities sold a 5% stake in itself a few years ago. Recently Tower Research announced plans to raise an external fund like a hedge fund. It highlighted the competitive and cost pressures in traditional HFT strategies and that this fund would raise capital to deploy in more medium-frequency strategies.

Hedge funds have grown considerably as financing clients of banks as money has flowed into leveraged strategies. But Jane Street traditionally seen as a major competitor to bank trading desks has also become a major client of several large investment banks in prime brokerage. HFTs traditionally relied on banks to provide them with market access but are increasingly becoming clients of banks in trading and financing. HRT self-clears in US equities but in other areas it relies on banks just like a hedge fund would.

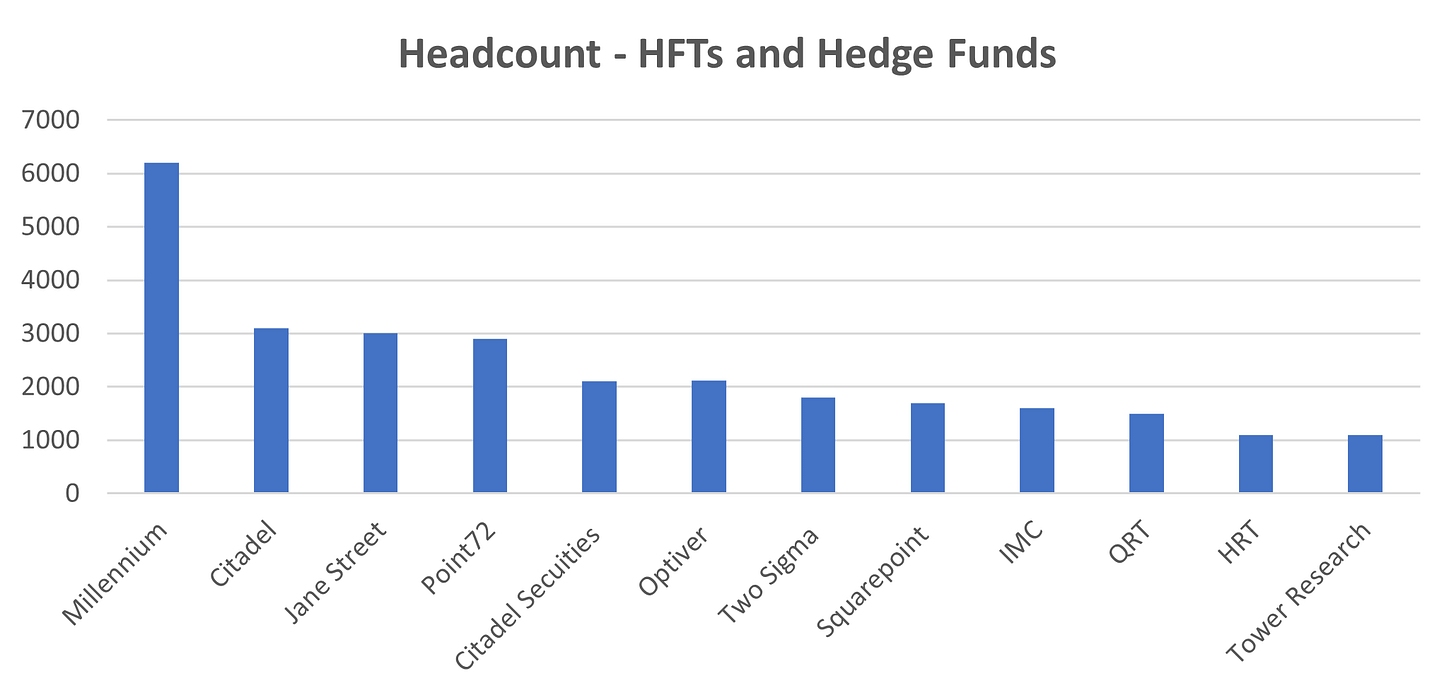

Fourth, we are seeing both the HFT and hedge fund universe become institutions in terms of the size of their headcount and the cost of their infrastructure. The chart below illustrates the headcount of a dozen of the top firms – half of which are hedge funds and half of which are HFTs. The tremendous growth of headcount at multi-strategy hedge funds is well known but the leading HFTs are on a similar scale. Optiver has nearly doubled its headcount over the last 5 years. HRT and Tower Research have seen a tenfold and threefold increase respectively over the last decade.

Just as investment banks and hedge funds have been in a multi-year talent war, hedge funds and HFTs are competing for talent in the areas of quant research, systematic traders, data scientists, and technologists. In the last few years, there has been much hiring by firms like Squarepoint and QRT in the area of high-frequency strategies. The structure of multi-strategy hedge funds and HFT teams have some similarities. Although P&Ls are not as discrete as at pod shops, some HFTs like Jump Trading have separate pods of investing teams with only execution fully integrated.

Finally, a key reason for the increased overlap of the HFT and hedge fund industries is their asset class expansion. For instance, a key growth area for HRT has been systematic credit, which inherently is going to be more medium frequency than cash equities. The market structure of a lot of derivatives and OTC markets is such that there isn’t the same split between principal and agency, and both the opportunity set, and skills required to succeed have more overlap.

We are in an era of blurred lines between different industry segmentation - the difference between what is the sell side and what is the buy side has fundamentally changed.

Great Article Rupak!

Awesome post. Learned a lot Rupak! Thanks!