The bank that won the battle but lost the war

Credit Suisse remembrance month - Part 3: Was the early death of Credit Suisse inevitable?

On 20th August 2009, Credit Suisse was running a sale process for the Swiss government’s 9% stake in UBS. The day before UBS was forced to hand over thousands of bank account details containing $18bn to the US government. How times changed!

After any bad financial event, commentators always say how the warning signs had been building up for years and the core had been rotten from the beginning. As JFK said or was it one of Mussolini’s crew “Success has many fathers, but failure is an orphan.” In the case of the early death of Credit Suisse, I had seen the grift with my own eyes from the beginning.

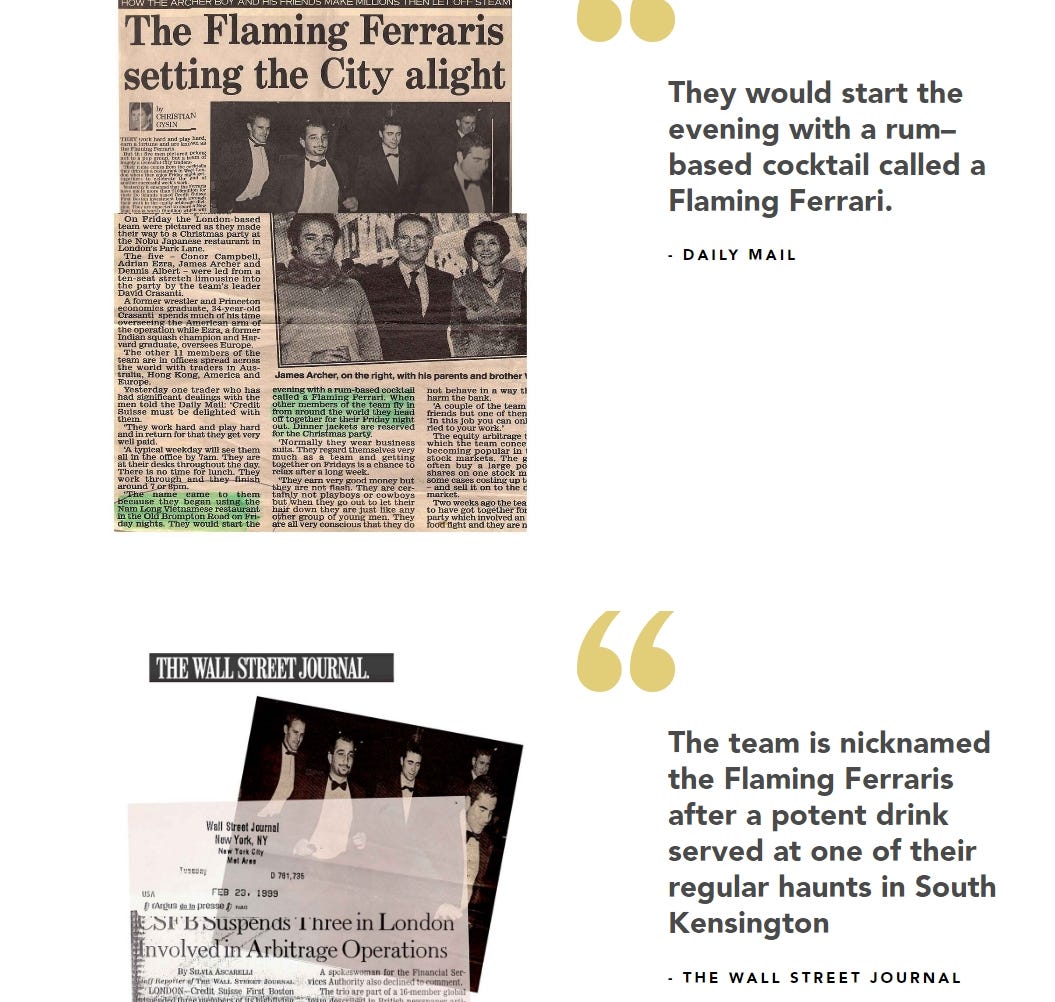

Very few of my friends at university in the late nineties knew much about the investment bank I had been offered a graduate role for until one of them came into the university bar with a newspaper page open on a juicy story about City traders from CSFB that drank Flaming Ferraris’ at the Nam Long restaurant on the Old Brompton Road in London, partied hard and made huge bonuses until a trading scandal. The traders were fired but the reason the story made so many papers was probably because one of them was the son of author Jeffrey Archer, who was at the height of his fame.

The newspaper clippings above are still prominently featured on the Nam Long restaurant website even now - over 25 years later. I walked by there a few days ago and it was very quiet - no sign of Flaming Ferrari traders!

At around the same time, CSFB paid hundreds of millions of dollars to hire legendary tech banker Frank Quattrone and his team, who had demanded total autonomy and that the equity research analysts covering tech stocks would report to the investment bankers directly. Morgan Stanley had refused this a few years earlier but CSFB hungry to play with the big boys was game. I saw this first-hand as I was working on the media research team during the Quattrone years, and we did several media and Internet IPOs. Those were crazy times before the Spitzer settlement, but CSFB was known for pushing the envelope.

Then there was the high price paid of $13.5bn for DLJ at the top of the stock market. Although some of DLJ’s legendary leveraged finance strength remained with Credit Suisse right to the end, much of what else made DLJ special left. The drain of top talent included Tony James to Blackstone and Ken Moelis to UBS.

But here’s the thing.

Most leading Wall Street banks paid large fines as part of the Spitzer settlement. Most other European banks paid way over the odds to buy into Wall Street.

As we headed towards the Global Financial Crisis, my colleague Dan Davies and I were tasked to cover the European investment bank stocks in addition to our diversified financials coverage. This was only really UBS and Deutsche Bank but not only was the former larger, covering it at the other Swiss investment bank meant you got more attention.

UBS were the cowboys - $50bn of sub-prime losses and a tainted legacy for the CEO Peter Wuffli. By contrast, Credit Suisse only took $10bn of write-downs (in leveraged finance as well as structured products) and bounced back very strongly in terms of huge trading revenues in equities and fixed income in 2009. It wasn’t a Fortress Balance Sheet but still maybe Dimon light!

The irony is that during those dark days of the Global Financial Crisis, Credit Suisse was a safe haven. Citi was going to go under. There was a run on Morgan Stanley and Goldman Sachs. Friends and family from all those firms were calling me saying how lucky I was to be at Credit Suisse. Even a lot of financial institutions would turn to Credit Suisse for help.

UBS wasn’t the only bank that had share sales led by Credit Suisse. There were many smaller banks but out of the biggest, one set of deals stood out. As Barclays corporate broker, Credit Suisse was involved in the series of capital raises and block trades by Middle Eastern investors that became highly controversial in later years.

If there is one area that tells the story of the rise and fall of Credit Suisse best, this is prime brokerage. This industry segment grew fast in the years before the Global Financial Crisis in line with the growth of the hedge fund industry and its appetite for leverage. The prime brokerage business was dominated though by Goldman Sachs and Morgan Stanley, which had early mover advantage in the space which was all about infrastructure, technology, and scale.

But when Lehman Brothers went under the share prices of Morgan Stanley and Goldman Sachs collapsed and hedge funds were running scared and looking for safe banks to park their prime brokerage balances. In the US many did go to JP Morgan which had acquired a leading player in the space, Bear Stearns earlier in the year. The one firm that won in prime brokerage on both sides of the Atlantic though was Credit Suisse. A solid number 4 player in the US (and by some estimates top 3) and according to Eurohedge the number 2 player in Europe by the first half of 2009.

So, why did Credit Suisse bleed out over the following decade?

Much has been written about the home-field advantage of the big 5 US banks particularly as US capital markets boomed more than European ones. A lot has also been written about Swiss secrecy changes and other business model headwinds for the lucrative Swiss private banking business.

But banks with huge balance sheets are at the end of the day a risk management game. At the time that Credit Suisse went under my friend Dan Davies wrote that the firm was just too obsessed with client ranking and keeping customers happy. Contrast that with Goldman Sachs which takes care of their balance sheet first.

There were many individuals involved in the success and demise of Credit Suisse, but the demise seemed to start - perhaps coincidentally - around the time that CS investment head Paul Calello passed away in late 2010. He had a close relationship with Credit Suisse CEO Brady Dougan from the time when Dougan ran equities and then the investment bank. Sure, at JP Morgan and Goldman Sachs, there is always a strong bench, but this was Credit Suisse.

Dougan was probably pushed out too late in 2015 but what about the choice of successor?

Bill Winters had been co-head of the JP Morgan investment bank during its growth years and through the Global Financial Crisis. He knew a lot about markets and was hugely well-respected. He was a free agent. He was appointed CEO of Standard Chartered an Asia-focused emerging markets retail and corporate bank in early 2015.

Tidjane Thiam someone passionate about Asia and emerging markets with an insurance background and no history in investment banking (and little in wealth management) where Credit Suisse’s greatest risks lay was appointed CEO of Credit Suisse in early 2015.

I remember thinking at the time surely the top-tier headhunting firms sent the wrong CV to the wrong Board!

Add to this the fact that despite a continuous slide in the share price and a decade without profits, Credit Suisse had the longest-serving CFO of any systemically important bank in place for 12 years and the same Chairman in place for a whole decade. There was also of course the famous head of risk appointment.

One thing never changed from the days of Quattrone – Credit Suisse was willing to give a regional or business P&L head unusual levels of autonomy relative to peers to bring in quick profits. There was growth in wealth management in international emerging markets and Asia fuelled by balance sheet expansion that was low multiple and unsustainable.

Maybe Credit Suisse should have listened to Goldman Sachs - don’t always put your clients first - especially before your shareholders!