The $100 billion Bloomberg for academics and lawyers?

RELX: the world of professional and business information vendors

The last decade and a half has been a time of plenty in the financial data, ratings, benchmarking, and analytics space. The share prices of the likes of S&P Global, Moody’s, LSEG, MSCI, and FactSet have skyrocketed. Privately held giants like Bloomberg are stronger than ever. But there is an industry very different but also very similar that has done equally well over the period. A sector of stock market darlings that spent decades in the relative wilderness.

This is their share prices…

Have you ever heard of Erik Engstrom, Steve Hasker, or Nancy McKinstry? They are the CEOs of RELX, Thomson Reuters, and Wolters Kluwer and this has been the share price trajectory of their companies. Boring data companies are flying with big tech in the AI boom.

Together these three firms generated around $25 billion of revenues last year in professional and business information in legal, academic, healthcare, accounting, tax, insurance risk, corporate risk, and other verticals for users across business, academia, and government.

I first came across this sector over twenty-five years ago when I was a graduate trainee in equity research covering media stocks. This was the heyday of the dot com bubble. There were hot media Internet IPOs and some traditional players like Sky TV were being re-rated like Internet stocks. The fun companies had freebies like EMI giving away CDs (remember those things!) or had cool stories like Sir Martin Sorrell and his advertising crew. And then there was Reed Elsevier, Thomson, and Wolters Kluwer. Try telling your mates at parties you are a media analyst not covering Hollywood but publishers of legal and scientific journals.

A $200 billion stock market goliath

The largest publicly traded professional information provider Reed Elsevier changed its name to RELX a decade ago. Steady but improved growth and profitability and a high degree of cash generation and capital returns have propelled its enterprise value (market capitalization plus net debt) to $100 billion!

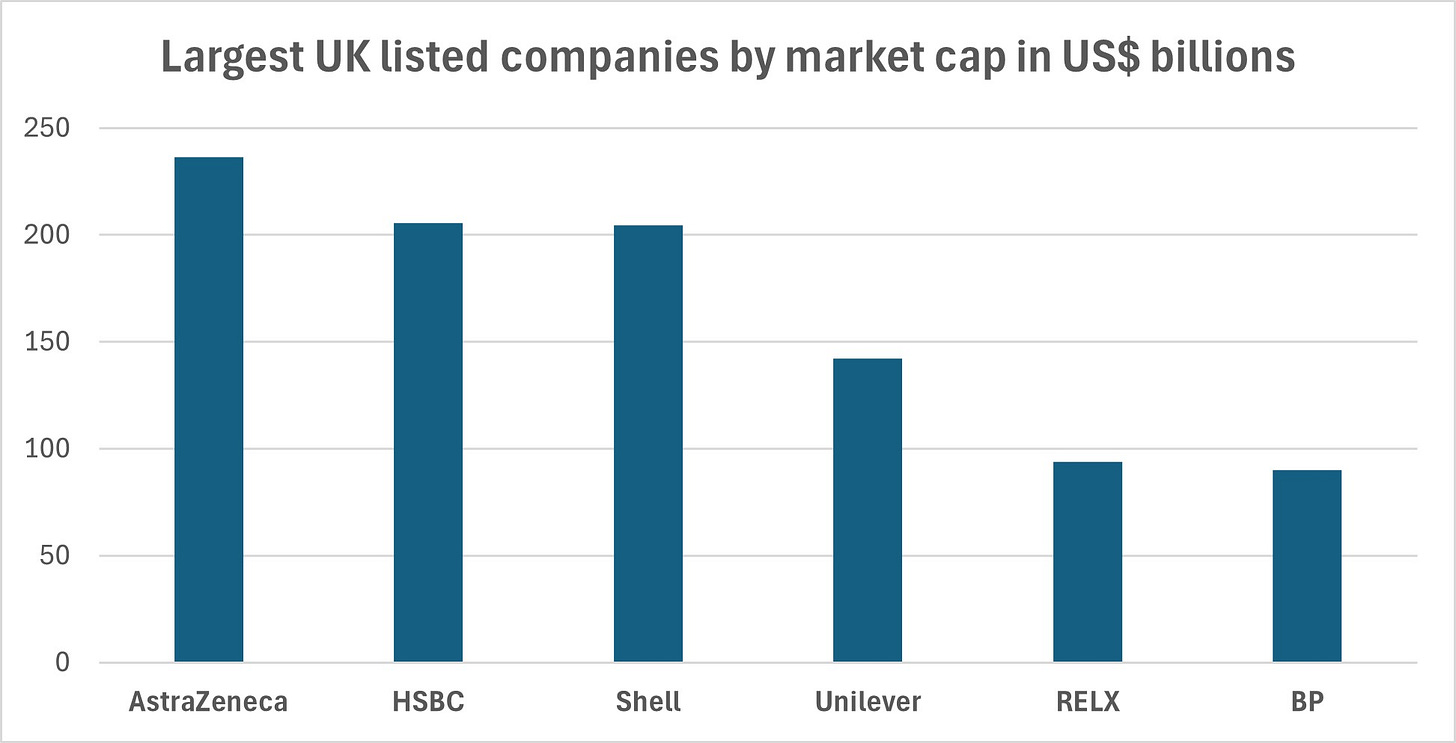

In the earlier share price chart RELX was the lower of the three lines but given its higher dividend payouts its overall shareholder returns have paced with its peers, and it is one of the best-performing large-cap stocks in the UK. The following chart shows that it is now in the top five largest in the UK by stock market value and bigger than BP. Its price-to-earnings multiple of around 30x is more like a tech giant.

The second largest listed player is Thomson Reuters worth around $80 billion (and this trades on a much higher price-to-earnings multiple than RELX). Add in Wolters Kluwer, and the much smaller Springer Nature which was listed late last year, and the combined stock market value of the four firms is more than $215 billion.

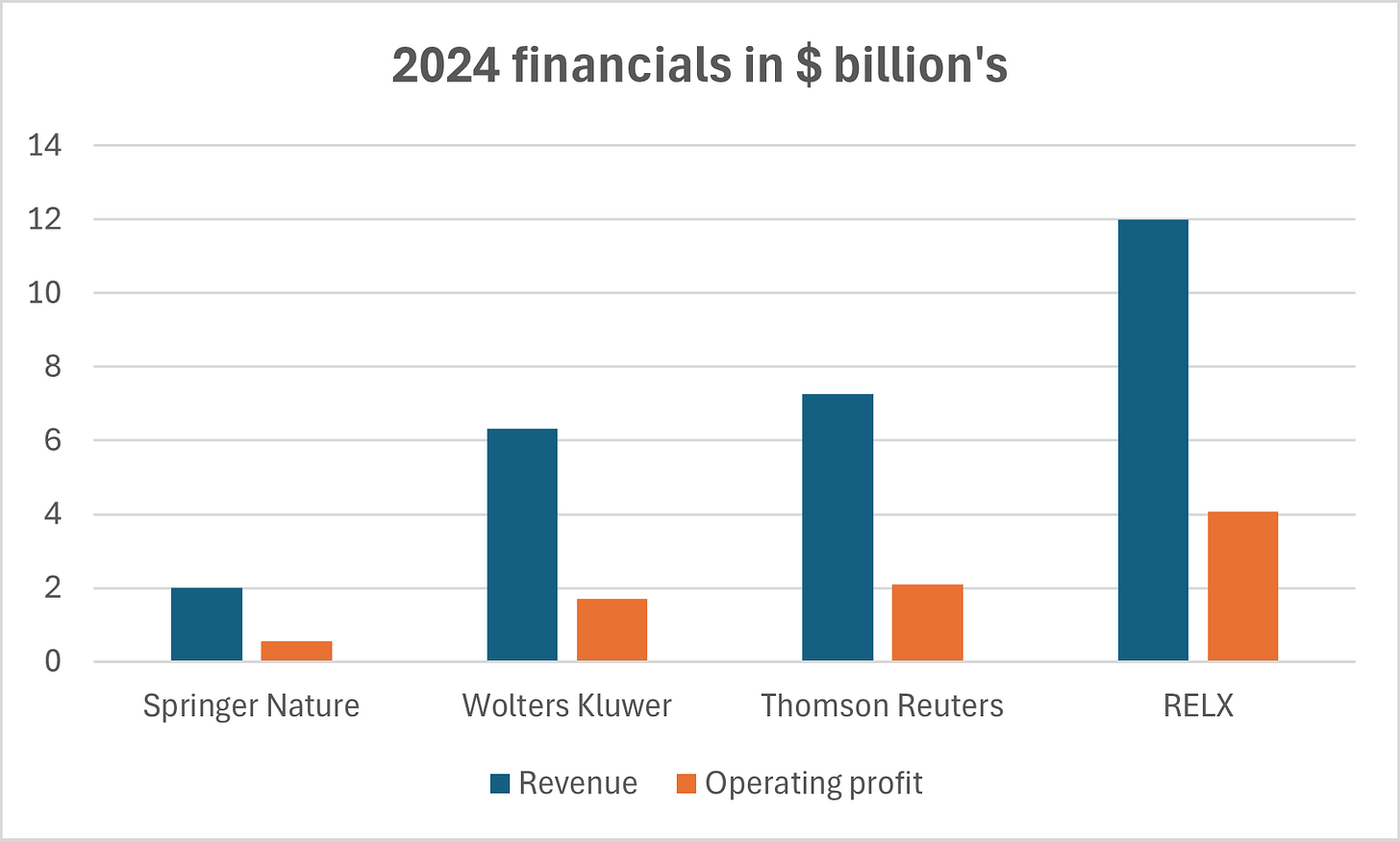

The following chart illustrates the revenues and operating profits of the four firms in 2024. RELX generated as much operating profits as its two largest peers combined.

Very different but very similar

Even now when the financial data sector has become sexy, the professional information, decision tools, and analytics firms as they are now known are hardly names that venture capitalists or finance social media influencers would ever mention.

There are many differences with Bloomberg given the latter has a singular brand, singular platform, and relatively cohesive customer base. Moreover, Bloomberg is loved by its users albeit hated by some of the banks that are its largest customers. But as you will hopefully see through this piece there are many similarities with Bloomberg and the listed financial data firms I have already mentioned.

Both sectors have done well for similar reasons:

Trends - Macro trends around regulation and risk monitoring, a shift online and towards platforms, and from raw data to analytics and decision tools. Industry market structure trends of consolidation, pricing power, and the big getting bigger.

Moats - If you looked at the financial market data, and professional and business information sectors from the perspective of the factors Peter Thiel cited in Zero to One as driving natural monopolies, it would be strong brands, network effects, and economies of scale rather than 10x better proprietary technology that are crucial in both industries.

Economics - These are not stories of explosive growth but consistency. Mid to high single-digit revenue growth with a steady margin expansion and high degrees of cash generation. Operating margins of 30%+ for the professional and business information providers are slightly lower than financial data businesses but the former are highly cash-generative and disciplined about returning capital to shareholders through dividends and share buybacks.

Manager mode and not founder mode - A great man theory of founders being at the heart of all value creation is not new but the idea of founder mode where a founder is involved in all major product decisions and has dozens of direct reports went viral after Brian Chesky’s speech last year. The financial market data space has of course seen its fair share of founders most notably Mike Bloomberg, but I would characterize it more as a manager-mode industry. Professional and business information vendors are similar. Delegated decision-making, incremental change, and building on existing moats rather than re-inventing the wheel. RELX CEO Erik Engstrom is famously understated and incremental in his approach. The exact opposite of brash tech bro founders. A man who travels at the back of commercial flights and rarely does interviews he has been in charge of RELX since 2010.

Who is the product and who is the customer - “It’s my data they are taking and selling back to me” the head of fixed-income trading at a major US bank told me a few years ago. If you have worked in financial market structure as long as me, I am sure you will have been in similar conversations. I remembered this again last year when I was reading the fantastic new book The Unaccountability Machine” by my friend and former colleague Dan Davies.

On page 22 Dan introduces the topic of the academic publishing industry. He outlines how academic publishing with its system of articles selected by editors and put through a “peer review” system (whereby other scholars anonymously review submissions, which are then revised) was originally largely a non-profit affair. Then the private sector realized that this was a good business to be in. He writes: “Firstly, the customer base is captive and highly vulnerable to price gouging. A university library has to have access to the best journals, without which the members of the university can’t keep up with their field or do their own research. Secondly, although the publishers who bought the titles took over the responsibility for their administration and distribution, this is a small part of the effort involved in producing an academic journal, compared to the actual work of writing the articles and peer-reviewing them. This service is provided to the publishers by academics, for free or for a nominal payment (often paid in books or subscriptions to journals). So not only does the industry have both a captive customer base and a captive source of free labour, these two commercial assets are for the most part the same group of people.”

In essence, the academics fight to help the publishers extract monopoly profits. The whole process depends on the value of having your articles appear or receive citations in the best journals. This becomes an unaccountability sink to which universities outsource their whole system of promotion and hiring. Davies compares this to the PageRank algorithm used by Google.

Cash cow academic publishing

This market for academic publishing generates around $20 billion of revenue per year with half of the market controlled by the five largest firms: Elsevier (part of RELX), John Wiley & Sons, Taylor & Francis, Springer Nature, and SAGE.

Recent trends include:

the growth of open-access publishing (leading dedicated open-access publishers include MDPI and Frontiers) where some content is free to the reader but with an increase in fees charged to those researchers submitting articles,

an increase in pressure on the budget of university libraries that are also clients,

and a huge growth in the number of scientific publications.

There have been several data-driven reports on the latter, with much of this growth coming from open-access publishers such as MDPI and Frontiers with questions around quality control here. One paper estimated that between 2016 and 2022 the volume of published research articles had grown by 5.6% per annum. Although much of the growth came from newer platforms, the chart below illustrates that RELX-owned Elsevier is not only the clear market leader, but it has also grown significantly in volume. Some of this comes from journals, which Elsevier has added to their stable (i.e., acquisitions) but there are questions about the sustainability of the underlying volume growth.

Chart of the evolution of the total number of articles published per year and publisher

Source: https://www.ouvrirlascience.fr/excessive-growth-in-the-number-of-scientific

RELX Elsevier has over 3,000 journals including leading brands like the Lancet. These journals published more than 720,000 articles in 2024. This is almost one-fifth of all scientific articles. Elsevier’s online platform ScienceDirect has tens of millions of pieces of peer-reviewed content from tens of millions of researchers. Its citation database has content from tens of thousands of journals.

The scientific, technical, and medical information division is RELX’s second largest with revenues of around $4 billion of revenues, roughly equally split between articles/research content vs databases, tools, and electronic reference solutions. The business is largely subscription fee driven and 90% of its revenues are from electronic products rather than print publishing and face-to-face events.

Despite the growth in the number of articles, this is RELX’s slowest-growing division with 3-4% revenue growth and 4-5% profit growth in recent years. They are expanding in line with our faster than the industry. But it is a very healthy cash cow with $1.5 billion of operating profits in 2024. This circa 40% operating margin is the best in the RELX group and far superior to other professional and business information businesses. The number two player Springer Nature has lower operating margins of around 30% in their academic publishing business, but this is much higher than their other products.

A large part of the RELX Elsevier business also comes from content, databases, and analytics for healthcare professionals such as doctors, nurses, and students. Here one of its main competitors with almost $2 billion in revenues is Wolters Kluwer.

Legal, corporate risk, and tax information

These markets are around $26 billion in size, so larger than academic publishing. Over half of these revenues go to RELX, Thomson Reuters, and Wolters Kluwer. These verticals are also faster growing than academic publishing with the legal segment growing in the 5-7% range and corporate risk and accounting solutions more like 7-9% per year.

In legal information, the market leader Thomson Reuters generates almost $3 billion of revenue and with operating profits of around $1 billion. Unsurprisingly scale means it has a much higher margin than its peers. RELX is the number two player with almost $2.5 billion of revenues but operating profits that are around half of Thomson’s here. Wolters Kluwer is also a competitor.

Just like academic publishing, there has been a gradual migration online so that virtually all revenues are today electronic, and the charging model is also predominantly subscription-based. The majority of revenues in this vertical come from research and analytics for law firms and corporate law with a small component from governments, academics, and news. Thomson’s primary online legal research delivery platform is Westlaw and for RELX it is LexisNexis. They have hundreds of billions of legal documents and records including hundreds of millions of US court dockets. Every day millions of new documents from thousands of sources are added to these industry-leading platforms.

The faster growth here is a function of the deep pockets of the client base and the greater penetration of analytics. Both market leaders have been investing heavily in AI as well. This includes both organic and acquisitive investments. For instance, RELX has it is own Lexis+ AI ChatGPT for lawyers that leverages the citations and proprietary content in the Lexis Nexis database as well as public content. In terms of acquisitions, Thomson Reuters acquired AI legal firm Casetext for $650 million almost two years ago. RELX has also spent tens of millions of dollars on deals. The first such acquisition was Silicon Valley IP litigation research company LEX Machina a decade ago and the latest is participating in the recent $300m funding round in Harvey AI one of the hottest GenAI legal startups which is backed by OpenAI and Sequoia.

The fastest-growing verticals are corporate risk and tax and accounting data and workflow solutions. Thomson Reuters is present in both. RELX is a leader in the former and Wolters Kluwer is the market leader in the latter albeit closely followed by Thomson Reuters. In the area of corporate risk, there is overlap with the likes of Experian and Equifax. Bloomberg also has businesses that overlap in both areas.

The engine of growth at RELX has been its risk business, which has a combination of macro tailwinds and a market-leading position. This has grown revenues and profits at high single-digit percentages in recent years. In 2024 it generated more than $4 billion of revenues and $1.5 billion of operating profits. The majority of this is transactional with much lower subscription revenues than RELX’s academic publishing business.

40% of RELX corporate risk division’s revenues come from business services such as online fraud and financial crime detection and prevention. Most leading corporates are their customer, as well as individuals. For instance, the LexisNexis Digital Identity Network analyses more than 121 billion transactions annually. RELX detected 690 million human-initiated fraud attacks and more than 2 billion automated bot attacks on customers in 2024. Over 500 million US consumer credit assessments were provided in 2024. Another 40% of this divisional revenue comes from risk assessment tools through the insurance lifecycle of underwriting, pricing, and claims and services. Virtually all leading insurers are customers. The next largest category is specialist verticals that provide insights around commodity markets, commercial flight data, and HR. Finally, there is also a small government advisory business.

People business

This industry of professional and business information vendors across academic content, healthcare, legal, corporate risk, tax, and accounting may be investing heavily in workflow solutions and becoming the GenAI agent for their industry but good old-fashioned manual processes are still alive.

Together the four publicly listed firms employ more than 90,000 people. RELX employs 50% more employees than Bloomberg. Getting data from a hugely diverse set of content contributors, managing huge proprietary industry databases, and a wide range of analytics still needs lots of people.

The chart below shows that in 2024 the three largest listed professional and business information vendors had revenues per employee of around $300,000. This is far lower than the $500,000-$600,000 per employee that Bloomberg generates and also well below other financial infrastructure platforms like LSEG or MSCI. Where financial data vendors have lower revenue per head than professional and business information vendors they tend to be the likes of FactSet that are focused more on cleaning data rather than more scalable benchmarks and marketplaces.

But even within the professional and business information sector, there are huge variations in productivity. RELX may be bigger than any of its peers, but its corporate risk and scientific and medical divisions generate a revenue per employee that is twice what its legal division generates. Within the academic and healthcare segment, RELX is almost twice as efficient as second-placed Springer Nature so it wouldn’t be surprising to see much lower levels of profitability at smaller firms.