“This man could sell anything to anyone”, the deal captain on my equity sales desk said to me. “Fredy is a legend I know” I replied.

That was after the initial investor soundings of the Partners Group IPO. I had the final piece of validation I needed. Partners management had just been in to see my smartest London hedge fund financials clients.

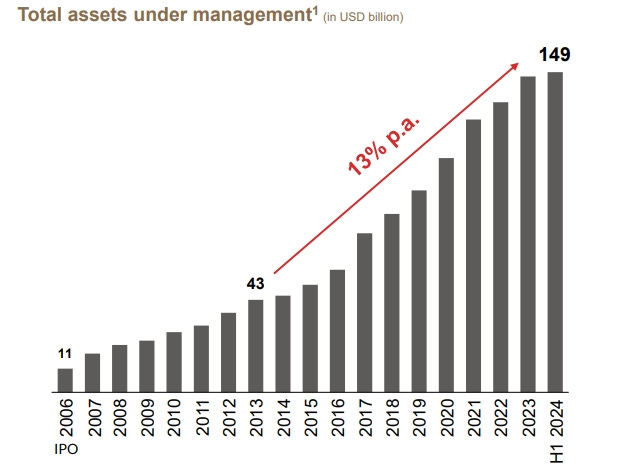

But let me start at the beginning. A few months earlier Credit Suisse and Merrill Lynch had been appointed as joint book runners on the IPO of this mid-size Swiss private equity fund of funds, which had only CHF10.9bn of AUM at the end of 2005 and 2005 revenues of CHF110m.

Credit Suisse had beaten UBS out to be the Swiss bank on the deal and Zurich bigwig Thomas Gottstein was fronting our ECM efforts, so I knew it was important. Ironically my Swiss sales team and most Swiss buy-side institutions weren’t particularly bullish. The head of Credit Suisse’s sales desk described Partners Group as unusual and thought Partners management strange for going up to the mountains for long planning offsites.

While Gottstein would go on to merely run a failed bank, the Merrill Lynch ECM effort was led by managing director and future GlobalCapital and FT contributor Craig Coben. Craig’s recent FT piece on why young bankers must work 70 hr weeks has even made him an Instagram phenomenon!

Partners Group was IPO’ed in March 2006. I was still in therapy recovering from being forced into leading investor education on Queen’s Walk. On a very cold winter day, I was sent down to near Zug for the usual analyst pre-education day with management. I knew little about Zug beyond tales of commodities trader Marc Rich.

I expected a flash hotel but didn’t see one. I expected a flash HQ for Partners Group but didn’t see one. I expected to see a flash management team but didn’t find them.

The three founders of Partners Group - Marcel Erni, Alfred Gantner, and Urs Wietlisbach - had set up the firm 10 years before in 1996 having met at Goldman Sachs. They were equal partners. Alfred known to us as Fredy was the Executive Chairman, Urs was the head of sales, and Marcel the CIO. They were ably assisted by their CEO Steffen Meister, who didn’t have the same amount of equity having joined in 2000 but together with Fredy led the IPO.

The whole Partners Group team was competent but what made them special was that they leveraged each other’s strengths seamlessly. On an IPO roadshow, you always have multiple teams on the road so all 4 were deployed but the stardust for selling the deal came from Fredy.

In between the IPO in 2006 and when I left Credit Suisse in 2011 for me Partners Group was about Fredy Gantner. He was not a classical private equity or fund of funds showman like Arpad Busson of EIM. There was no Elle Macpherson or Uma Thurman. Fredy despite being Swiss had studied at Brigham Young University in Utah. He was a devout Mormon and had 5 kids. Things that were not easy for me to relate to as a twentysomething analyst.

But Fredy’s wife was Indian as he reminded me often! We once went to see a multi-billion-dollar financials PM in London together and Fredy was on full flow. I can’t recall how the conversation started but he ended up saying “Too many Indians and not enough Chiefs”. It hadn’t registered to me and I had forgotten about it when I got a call later that evening from Fredy apologizing. This was well before the times of diversity - neither had I taken offense, nor did he need to apologize. He made the joke “don’t tell his in-laws”, that I will never forget. A class act!

In my 12 years as a sell-side equity research analyst, I met dozens of Chairs and CEOs but two stood out amongst the rest for their perfect combination of warm charm but aggressive and relentless negotiation/salesmanship - Michael Spencer of ICAP who I subsequently worked for between 2012 and 2019 and Fredy Gantner.

Partners Group had a great story. Explosive revenue growth. The boom in alternative assets. Highly cash generative. But it wasn’t a slam dunk. Very few people will remember but there was a lot of negativity around a private equity firm selling to public investors in 2006. Moreover, was a fund of funds a good business model.

Although Partners Group had made a very small amount of direct private equity investments largely co-investing with sponsors, they had relationships with, virtually all of its revenues came from fund of funds.

But what I got and so did some of the largest financials hedge funds in London was that when Partners Group won new business it was not like listed hedge funds such as Man Group or traditional asset managers. The new business wins in its private equity fund of funds was locked in for 10-12 years with fees charged on commitments. An annuity stream which was better than an insurance company. Hence valuation on the stock was not merely about growth but the stickiness of the P&L. These were locked in management fees and on the other side of the P&L, Partners Group was so different from the rest of the private equity industry. No huge graduate salaries or rainmaker bonuses. A very consistent cost structure.

The Partners Group story got no real interest in Europe or amongst the UK long-only community. The Swiss stepped up because it was a local listing but the big delta on the success of the IPO was the demand from a few large London hedge funds and US investors. Coincidently, this was also my client base. The limited free float and low liquidity meant the shares kept going up, but it was ironically never a stock that the sales desk wanted me to speak about at the 7 am sales and sales trading morning meeting.

The Partners Group IPO was priced at CHF63 and traded up to CHF83 straight away. 18 years later the Partners Group share price is above CHF1,250. This is a staggering 20x return if you had held on all the way through.

Former Merrill Lynch banker Craig Coben said to me the other day “We knew it was going to be a hot IPO, but even the most enthusiastic investors couldn’t have foreseen how phenomenally successful the company would be.”

But this was not an IPO about offering a cash-out event for the management team. More than most IPOs it helped to build the brand of the firm. It took a niche Swiss fund of funds business global. Soon Partners Group was expanding its client base in the UK and the US rapidly. It was able to expand its suite of evergreen fund structures to a wider audience of retail investors. It was able to hire talent more easily.

I was the big bull on the stock for a while but alas a few years later I got off the bandwagon. They closed their hedge fund of funds business which was always a weak franchise. Fredy came to my office with a new head of real estate investing he had hired from one of the big West Coast allocators, but I struggled to see the pivot from being a fund of private equity into competing directly with the likes of Blackstone, Apollo, and KKR. I was wrong and it is one of my biggest regrets in investing.

Sometimes you just have to believe in a management team and company’s culture and that they can play outside of their lane.

Partners Group had a core customer base of German and Swiss insurance companies and pension funds that were dying for yield and trusted Partners Group with their money. More than a decade of zero interest rates, global economic growth, and the surge in private equity, real estate, infrastructure, and private credit have also been massive tailwinds since then.

To my defence when I stopped following Partners Group in mid-2011 it was only beginning to make that pivot. In late 2012, Fredy and his founders sold hundreds of millions of dollars of Partners Group stock and reinvested the majority in new Partners Group funds investing directly in mid-cap companies. The loyal insurance and pension fund clients wanted them to have skin in the game.

The irony is that they didn’t do the placing through Credit Suisse but called up Morgan Stanley. Virtually no investment bankers were calling them - I bet that isn’t the case today with their CHF34bn market cap, US$149bn of AUM, CHF2bn revenue run-rate, and CHF1bn net profit run-rate.

When I heard about the stock placing and then I emailed Fredy to congratulate him and tell him life had taken me in a different direction and I was now in-house running strategy for Michael Spencer at ICAP, Fredy’s response was…you were great, but you got off too early.

If anyone doubts that Partners Group has made it to the big time the recent announcement that Blackrock is seeking its help in private equity with US retail investors tells the story.

Ride your winners!

Great story, thanks from someone who passes by Partners Group‘s offices almost every day.