When I was at university in the late nineties the dream job for anyone interested in finance was Goldman Sachs or Morgan Stanley front office. I speak to the top STEM graduates from Oxbridge, MIT, and similar places and these days it is private equity or hedge funds. But there is one firm that is top dog through their eye-popping salaries for interns – Jane Street. They have even started to throw large six-figure USD salaries to kids at IIT in India Jane Street hires from IIT Madras

Jane Street’s ability to attract the outlier genius or even the next Sam Bankman-Fried is predicated on Jane Street having lots of money to throw around and significant brand equity.

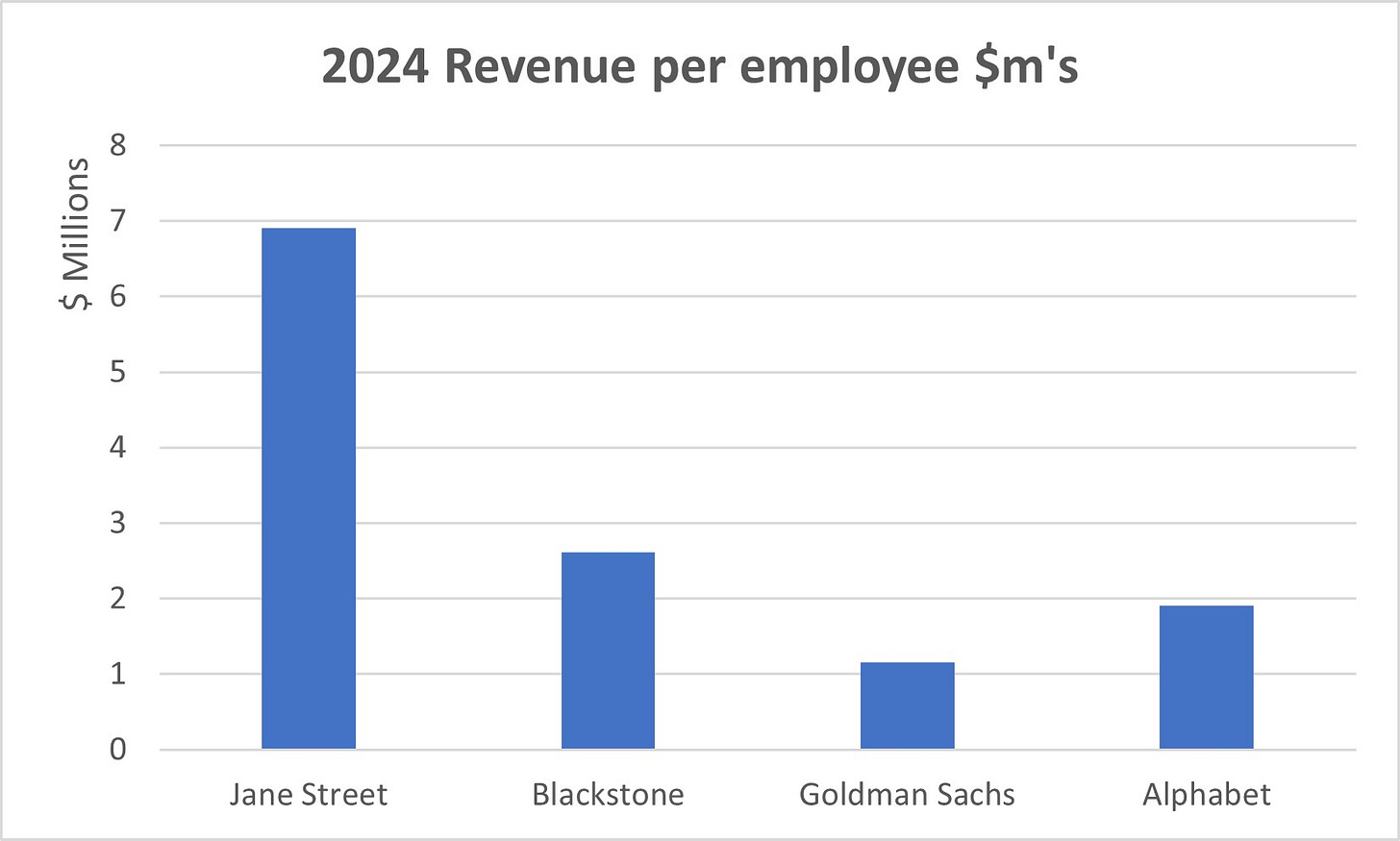

Briefly on the former, it is worth noting Jane Street’s revenue per employee annualizing Q1 2025 levels is near $10m! The contrast to peers is very stark with only top hedge funds coming on a par.

But Jane Street’s brand equity within its niche shouldn’t be underestimated even if it wasn’t a Main Street brand. Its devotion to OCaml rather than C++ brings sarcasm from some peers but has created a cult reputation like something out of an episode of Dallas. For years it has been religiously sponsoring Maths Olympiads as well as events related to tech research including ones with the likes of Nvidia. Jane Street is very thoughtful about its outreach and increasingly competing with Silicon Valley in this. Most recently, they have sponsored this podcast popular in tech circles from Satya Nadella to the next generation Dwarkesh Patel Jane Street puzzle

But how and why has Jane Street defied gravity?

Growth, scale, and scope

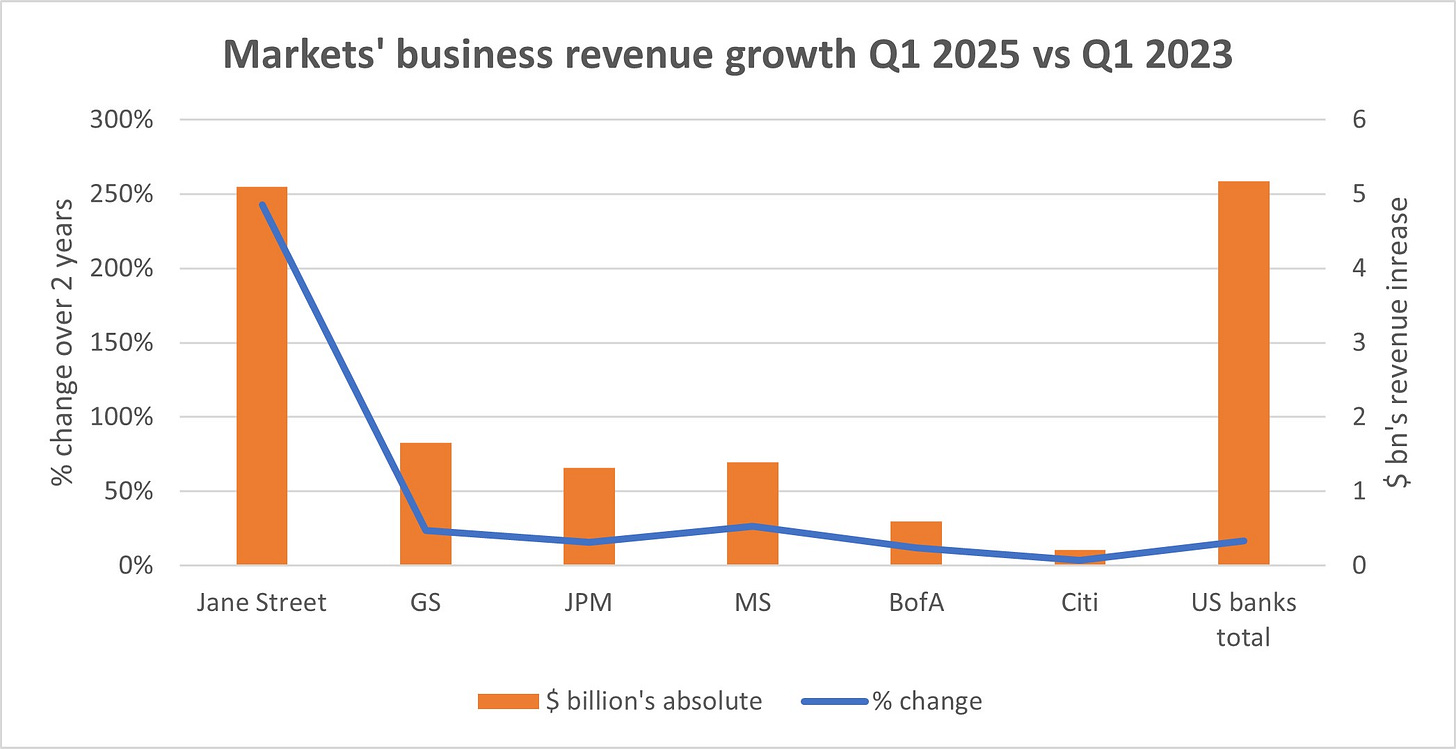

This week Jane Street reported revenues for Q1 2025 of over $7 billion, a 60-65% increase year on year well ahead of what the investment banks reported in their markets/trading divisions. Not only is Jane Street growing faster, but they are also bigger than all apart from JP Morgan and Goldman Sachs. And they are doing it much more profitably with net income annualizing at $15-20 billion. This makes it one of the most valuable private financial services in the world, probably only behind Citadel (hedge fund plus market maker) and Bloomberg.

Jane Street’s new bond prospectus gives us some updated statistics on its huge scale and scope. The guidance of $7.2 billion of revenues implies a more than threefold increase versus Q1 2023. Jane Street has added $5 billion in quarterly revenue over this period, the same as the big 5 US investment banks combined. The chart below illustrates this absolute increase in terms of $ billion of revenues in the bars using the axis on the right side of the chart and the % growth in the blue line using the axis on the left side of the chart.

Jane Street is known for being a pioneer in ETF trading, particularly in fixed-income ETFs and they continued to win market share last year here. For instance, its market share of secondary trading in UST ETFs inched up from 14% in 2023 to 16% in 2024. It also has very strong market shares across other ETF markets including Europe.

But this alone doesn’t explain Jane Street’s ETF success. Whether it is pure market making or proprietary trading they simply make money from the same volumes. For instance, if we look at Jane Street’s ETF trading volumes, they are five times larger than the only publicly listed ETF market maker Flow Traders. The latter makes around $500m of revenues from trading ETFs. Although Jane Street doesn’t disclose the breakdown of its $20bn of net revenues, it is hard to imagine that it did not make materially higher revenues from ETFs than $2.5bn.

Flow Traders shareholders had ramped up its share price in expectation of bumper Q1 results and were sorely disappointed this week. Although its ETF volumes in the first quarter increased 24% year over year in line with the broader ETF market, its revenues barely grew year over year and its Americas revenues collapsed 72% to a mere €11m. Trading firms are opaque businesses but as I said to an investor a while back Citadel Securities is run by Peng Zhao, a quant genius, XTX is run by Alex Gerko a quant genius, and Jane Street is probably run by many quant geniuses while Flow Traders choose a Bain management consultant to be CEO. He resigned this week!

Even if Jane Street makes a lot more than $2.5bn of revenues from ETFs, it still implies a huge amount of money being made in other asset classes.

Jane Street doesn’t break down its volumes in corporate bonds but across all fixed-income products, it has average daily volumes (ADV) of $11bn in 2024. It is also consistently a top 5 market maker in credit on electronic trading platforms like Bloomberg, Tradeweb, and Marketaxess. The latter had corporate bonds ADV of $14bn in 2024 across US investment grade, US high yield, emerging markets, and Eurobonds. Industry ADV for these credit markets is likely to be $70bn.

One of the earliest products that Jane Street started trading at the same time as ETFs was US-listed options. In 2024 it traded nearly 1 billion Options Clearing Corporation (OCC) contracts and was 8% of OCC volumes. The OCC clears all US exchange-traded equity options. So Jane Street was almost one-tenth of the gigantic US exchange-traded options market. Jane Street is also an active player internationally.

In equities, an ADV of $67bn last year means that Jane Street’s pipes and infrastructure see more equities volumes than all European stock markets combined. Jane Street has more than 10% market share in North American equities. This is not just about loads of young kids punting all day. The firm has become a major institutional player and is a top 5 wholesaler of retail flow behind the likes of Citadel Securities. Jane Street has also quickly become a major player in Europe as well emerging on lists of top systematic internalizers.

Longevity of tenure and alignment

The pod shop bidding war has been fierce in recent years. The problem with high alpha-generating businesses is retaining talent. Talent is in demand and the faster a sector is growing the greater the demand.

Rather than just a star trader or founder, Jane Street is run by a committee structure and its 38 equity holders have an average tenure of 17 years. Each trading desk or business area is run by one of these 38 equity holders who are aligned with the firm’s success given they provide the vast majority of the capital base of the firm. Huge growth and profitability have meant that Jane Street has thrown off lots of money for its owners in recent years. But what is particularly interesting is how virtually all of it has been retained in the business to grow the capital base as opposed to being paid out in dividends to buy private jets, islands, or basketball teams. It is almost cult-like in comparison to other financial institutions.

Jane Street is very careful about how it invests in the business whether it be product expansion, capital expansion, or hiring. For all the publicity on its growth headcount last year only increased by 12%. Revenues are running almost 3x what they were 4 years ago but headcount has only grown by 50%.

Of course, there is a virtuous cycle from being on a winning team and in bull markets for their core ETF business, so the billion-dollar question is what happens to tenure and retention in a downturn.

A large capital base

Jane Street has been a regular in issuing bonds in recent years and today has more than $10bn of outstanding debt in addition to its shareholder equity, which has grown from $3.8bn at the end of 2019 to $30bn by the end of 2024. In 5 years, it has added $26bn to its equity capital base, which compares to adding $2.4bn in the prior 5 years and $600m in the five years before this.

Only just over half of Jane Street’s $41.6bn capital base is required to meet the current margin requirements of its prime brokers. Jane Street discusses keeping a liquidity buffer of $6.4bn to manage through volatile periods but the size of the capital base is a huge differentiator versus other nonbank market makers.

At the same time, Jane Street has the advantage of not facing the same regulation that banks do, and it takes advantage. Jane Street’s Q1 revenues are in line with the average of the 5 US bank markets businesses (JPM, GS are higher but MS, Citi, and BofA are lower) but the US banks carry an average of $50bn of equity capital in their markets’ businesses to generate this same level of revenues.

More than the sum of its parts

Critics like to highlight the $1bn that Jane Street was making from Indian options as anecdotal of the fact that it is a card-counting Las Vegas-type casino and not a proper market maker in scale and competency.

Jane Street is not the same as a bank market maker but that is its strength. A multi-headed beast competing with hedge funds, competing with Chicago-type prop firms, and investment banks. It has scale across more overlapping markets than virtually all investment banks but without captive flow like the FX trading desks of the banks. The scale and scope of the flow, ranking as a top liquidity provider on so many electronic trading platforms, and as a wholesaler for the likes of retail brokers are traditional sell-side activities but the alignment of capital with its employees (at least the 38 equity owners) is more like a hedge fund or Geneva-based commodities trading house.

What proportion of Jane Street’s revenue is classified as flow market making versus proprietary trading is as much art as science depending on definitions. It is likely a mixture somewhere in between a bank trading desk and a hedge fund. But it is worth noting when comparing the scale of the franchises that the investment banks are generating 25-50% of their markets’ business revenues from financing hence it is likely that Jane Street’s market-making revenues are just as large as the likes of Morgan Stanley.

One of the common risk factors throughout all of Jane Street’s bond prospectus’ is its dependence on prime brokerage services from banks. So, are the bank’s competitors to Jane Street, or are they frenemies?

Another common theme throughout Jane Street’s disclosures is that it often leaves individual trading desks with directional exposure or risks that it hedges using its central risk team. The way Jane Street describes its central risk team is very much like the leading pod shops such as Citadel and Millennium. Probably more like Citadel than Millennium in that the former has a more centralized model, a more active central risk book, and less rigid drawdown limits for each trading desk. Where Jane Street fundamentally differs from the pod shops though is in its compensation structure, which is not based on a “eat what you can kill” how much money your specific trades make mentality. Jane Street pays staff on a combination of individual and firm impact so more like an investment bank.

In summary, Jane Street’s uniqueness is its moat – part tech prop trading firm, part hedge fund, part commodities trading house type partnership, part investment bank market maker with huge balance sheet.

Be different!

I just discovered your Substack today and wanted to say how much I appreciated your analysis, especially your insights across various market makers and the evolving landscape of UK fintechs and neobanks. Your writing is sharp, accessible, and genuinely thought-provoking.

Looking forward to following along and reading more of your work!

Great look at Jane Street. Quants are certainly having their day.