JP Morgan CEO just got paid $39m for 2024, an 8% increase versus the prior year. That is a huge amount of money by any standards.

But Goldman Sachs just handed CEO David Solomon and President/COO John Waldron $80m retention bonuses each. Solomon was also paid $39m for 2024. On this basis what is Jamie Dimon worth - is he the most underpaid CEO on Wall Street?

Last year when there were rumours that Jamie Dimon might retire sooner than expected the JP Morgan stock dropped almost 5% in a day. Susquehanna founder Jeff Yass who is in the news these days because of his sizeable investment in TikTok wrote in a letter in the Wall Street Journal “Maybe the shareholders should do a GoFundMe page to get Jamie back. Just saying.”

Dimon is a multi-billionaire who is probably at the stage of life where legacy is more important than the marginal dollar or tens of millions of dollars. But you have got to wonder why only 31% of JP Morgan shareholders voted in support of a $52m retention bonus for Dimon in 2021/2022.

Dimon is outspoken and doesn’t need anyone defending his corner but in an era of tech bro oligarchs and masculine energy, it is worth reflecting on Dimon’s compensation relative to his peer group.

Of course, CEO compensation outside the US is typically materially lower than in the US. The CEO of Europe’s largest bank HSBC (if you can call it European!) Noel Quinn was paid $13.4m for 2023, almost double the prior year after hitting financial targets. There is also the small point that comparing international banks like HSBC to JP Morgan is like comparing Poundland to Amazon.com.

There is a tug-of-war between the different viewpoints on CEO pay. On the one hand CEO pay is tiny compared to the market value and profits of huge multinationals. There is fierce competition to attract top talent globally, and private equity and privately-held companies are aggressive payers and bigger than ever. On the other side, the disparity between CEO pay and median employee pay is larger than ever, in line with the widening inequalities across society. Moreover, are CEOs as impactful as Lionel Messi or LeBron James are in professional sports?

Nevertheless, the focus of this piece is not on absolute levels of compensation but relative ones. How was Jamie Dimon - the most successful banker of this generation - paid relative to his peers?

There is much written about the hundreds of millions of dollars and sometimes billions that top private equity and hedge fund founders got paid over the last two decades but the business models, ownership structures (e.g. founders), and influences (e.g. CIOs taking all investment decisions at a hedge fund) can be different so here we focus on Dimon relative to the 5 largest US banking peers.

In 2023 Jamie Dimon was paid $36m, which compared with $37m for Morgan Stanley’s outgoing CEO James Gorman, $29m for Bank of America CEO Brian Moynihan, $29m for Wells Fargo CEO Charlie Scharf, $26m for Citigroup CEO Jane Frazer and $31m for Goldman Sachs CEO David Solomon.

What is interesting about these banks is that their scale in terms of revenues, profits, and market capitalization as I noted in House of Dimon is very different. JP Morgan’s revenues of $180bn are 75% larger than Bank of America, more than twice as large as Citigroup or Wells Fargo, and three times as large as Morgan Stanley or Goldman Sachs. A similar trend can be seen in terms of profits and return on equity.

JP Morgan is of an order of magnitude larger than these peers but Dimon was only paid slightly more than peers.

But surely this is a snapshot in time and a pay-for-performance culture would have shown up over the long-term?

Jamie Dimon became CEO of JP Morgan in 2006. Since then he has been paid $525m in compensation. Only Lloyd Blankfein and David Solomon at Goldman Sachs at around $550m have made more than this and this to because of the recent Solomon retention bonus (which has been announced but not paid out). And let’s face it Goldman is Goldman - the vampire squid of capitalism as Rolling Stone Magazine once called it.

The next largest is Morgan Stanley at around $450m with John Mack having some huge payouts pre-financial crisis and James Gorman’s pay rising in tandem with Dimon’s over his long reign and transformation of Morgan Stanley.

Wells Fargo has seen 4 different CEOs during Dimon’s reign: Richard Kovacevich in 2006, John Stumpf from 2007 to 2015, Tim Sloan, and over the last 5 years Dimon’s protege Charlie Scharf. Together they have been paid around $400m over almost two decades.

Citigroup has paid out around $375m over the two decades to Chuck Prince, Vikram Pandit, Michael Corbat, and Jane Frazer. Of course, they suffered the most dilution in terms of share price collapses during the Global Financial Crisis (GFC). Then again Citigroup also paid $800m for hedge fund startup Old Lane just before the GFC largely to get Pandit onboard.

At the bottom of this peer group of 6 US banking giants is Bank of America, which was just below Citigroup despite a market capitalization today that is a multiple of Citigroup. Here I have looked at Bank of America alone so Ken Lewis and Brian Moynihan and not the Merrill Lynch side.

What is clear from these stats is that pay and scale were not correlated. Neither was necessarily pay and long-term value creation for shareholders. Many banks like Wells Fargo clawed back tens of millions of bonuses but had to pay up to attract the next CEO. Unlike JP Morgan, the transition from one CEO to the next added tens of millions of dollars in cost to its competitors.

Looking at relative share price performances as a proxy for the success of CEOs, since Jamie Dimon became CEO of JP Morgan, the JP Morgan share price has risen more than 550%. Only Goldman Sachs at a 375% increase comes anywhere near it with Wells Fargo and Morgan Stanley up 150% and 180% respectively. The track record since 2010 has also been stark.

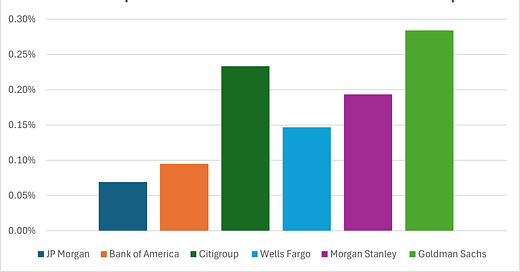

Relative market capitalization is a good proxy for a combination of performance and scale given many peers had more dilutive share issuance during the GFC. The chart below divides the total CEO compensation numbers during Dimon’s reign as a percentage of the market capitalization of the 6 banks. Dimon may been paid 20% more than the median of the peer group but it looks like only Bank of America got anywhere near as much value. Goldman Sachs and Citigroup paid their CEO 4 times and 3 times as much as Dimon relative to market capitalizations.

The outperformance of the JP Morgan share price has in itself been rewarding for Dimon and his senior executives who rode this up to riches so nobody is going to take pity on Dimon. But in an era where Silicon Valley and big tech have taken corporate compensation stratospheric, JP Morgan shareholders should be happy that they have got value for money!