If you can't trust a Swiss banker, what's the world come to?

Credit Suisse remembrance month Part 4 - Swiss pride

America may provide its military to defend Western interests but go to the right dinner parties in Zurich and Geneva and they will tell you Switzerland’s private bankers defend Western interests. If you can't trust a Swiss banker, what's the world come to? James Bond said.

UBS and pretty much every wealth manager and investment bank have reported great Q3 2024 results in recent days as booming US stock markets over the last year and a massive September stock market jump in China, Hong Kong, and Japan led to surging trading activity by institutional investors and high net worth individuals. This is particularly so for a bank like UBS which makes most of its trading revenues from equities rather than rates and has a market-leading wealth management footprint in Asia. UBS saw a huge increase in its Asian wealth management profits in Q3 2024.

The UBS-Credit Suisse deal is all about wealth management but were the investment bankers the only ones to blame for Credit Suisse’s downfall…

First Boston Cowboys

Credit Suisse’s investment bankers were cowboys - it was in the DNA of 11 Madison Avenue, New York, and One Cabot Square, London - ever since the First Boston days. No one is denying this.

But did they have more major blowups on compliance than other Wall Street firms? The $5.3bn settlement with US authorities in 2017 related to residential mortgage-backed securities Credit Suisse sold between 2005 and 2007 got a lot of attention, partly because CEO Tidjane Thiam made a big thing about it, but it wasn’t large compared to what some other Wall Street banks paid. For instance, Bank of America Merrill Lynch paid $16.7bn, JP Morgan paid $13bn, Deutsche Bank paid $7bn and Goldman Sachs paid $5bn.

More recently there had been the Mozambique Tuna bonds scandal and the huge Archegos risk management disaster but even the mighty Goldman Sachs has had scandals like 1MDB and, Deutsche Bank, and others had a litany of fines around Libor and FX.

The bigger problem was that Credit Suisse’s investment bankers unlike their competitors just didn’t make enough profit – well any profit – but once Credit Suisse started a decade-long shrinkage of the investment bank rather than one swift action the constant re-arranging of the deck chairs meant that the investment bank ended up massively overpaying to retain or hire talent and were distressed sellers of assets. All this, without real captive flow from the rest of the bank as the likes of HSBC and Citigroup have in their FX trading business from transaction banking.

Asset/Wealth management blow-ups

Some of the biggest compliance breaches and risk management failures at Credit Suisse were not in the investment bank - something the tight-knit Zurich elite with their client media outlets like to ignore!

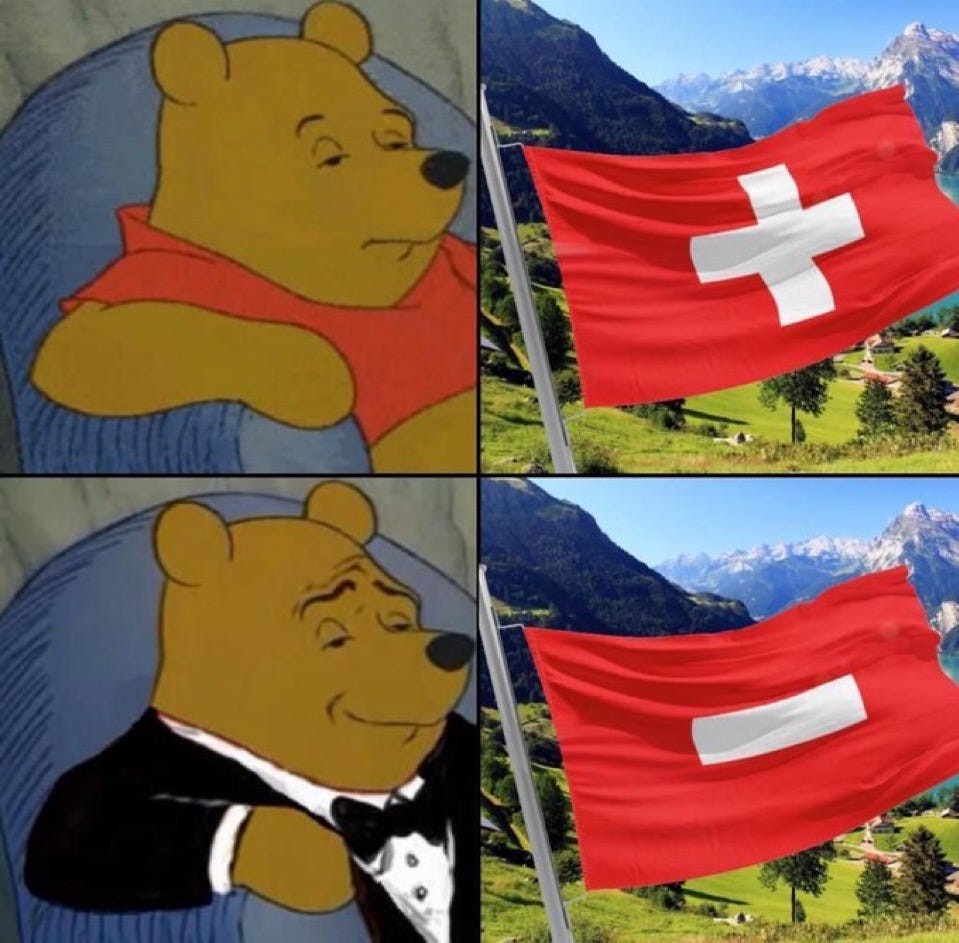

But surely the simple and honest Swiss bankers were led astray by their cunning and disreputable colleagues with First Boston breeding?

The argument has some legs. Leaders from the investment bank spread out across the firm to take the role of asset management CEO, group CFO, and even group CEO.

But Brady Dougan left in 2015, eight years before the end. Once he departed, new CEOs and the Chairman had to bless whoever was CFO. No one can say that Bobby Jain who left in 2016 to be co-CIO of hedge fund Millennium is not a good risk manager. As for his successor at Credit Suisse asset management, it shouldn’t be forgotten that asset management reported to International Wealth management under Iqbal Khan and then Philipp Wehle during the Greensill scandal. The latter was of course a joint client of asset management and wealth management.

Swiss private banking had historically been very profitable. For decades, bank secrecy and the safety of Switzerland were key competitive advantages but the landscape has changed. That said structural growth markets like Asia are not quite the same as the Swiss private bank: clients in Asia pay lower recurring fees, move from bank to bank more often and private banks have to share more of the pie with their relationship managers.

But are dodgy clients a feature rather than a bug of Swiss private banking?

I have probably been watching too many movies. Who can forget Mr Mendel who is responsible for all monetary transactions during and after tournaments at Casino Royale and turns up with a briefcase for a recovering James Bond at the beautiful Villa del Balbianello, Lake Como. Then there is the Geneva banker Jean-Jacques Saurel who aids Jordan Belfort in money laundering in the movie Wolf of Wall Street.

There is the small matter of fines and reputational damage from helping wealthy clients evade taxes and wash the proceeds of criminal activity.

Unlike UBS, Credit Suisse led by its Chairman fought US authorities which ended up leading to a bigger multi-billion dollar fine for its client tax probes in 2014. It also failed to clean up its act after the fines leading to more bad coverage. New stories on Department of Justice and Senate probes into whether Credit Suisse had violated the terms of this settlement were particularly timely just days before Credit Suisse’s ill-fated investor day in October 2022. There was also the court case earlier in 2022 of a cocaine-smuggling Bulgarian wrestler, who was laundering proceeds through Credit Suisse’s Zurich branches.

Of course, the increase in scrutiny by governments forcing private banks to hand over client information and pay large fines is not exclusive to Credit Suisse with UBS in a decade-long battle with French authorities on the laundering of the proceeds of tax fraud. Fines for this started at €4.7bn and have been recalculated down to €1.8bn with UBS still fighting this.

But what was structural about Credit Suisse’s wealth management was a willingness to take on more risk. Iqbal Khan is famous for growing and turning around the profitability of Credit Suisse’s international wealth management business but so much of this was aggressive lending in emerging markets. Similarly, Credit Suisse’s Southeast Asia success was balance sheet intensive. It was also an example of those running global markets and investment banking divisions losing control of part of their business to a local CEO. Helman Sitohang, the friend of Indonesian oligarchs and a big proponent of Lex Greensill was given the whole Asia P&L including wealth management, investment banking, and trading.

The Credit Suisse UBS revolving door

This brings me back to who was running Credit Suisse. One of the things I always noticed when working at Credit Suisse was the fact that most people right at the top in Zurich had worked at both Credit Suisse and UBS and not foreign banks.

Although there was churn in many roles, the one constant for over a decade was Chairman Urs Rohner, a consummate Zurich insider. The spying scandal and arguments between Tidjane Thiam and Iqbal Khan about how high the hedge between their Lake Zurich houses should be are hardly First Boston related. When Credit Suisse imploded the Chairman was Axel Lehmann, the former chief risk officer of the giant Zurich Insurance Group who had numerous roles at UBS including Board non-executive director, Group COO, and President of UBS Switzerland. Credit Suisse’s last CEO was Ulrich Körner who had been UBS COO and candidate for the UBS CEO role.

At least UBS got a free hotel…

All of these Zurich insiders will have enjoyed the luxury of Credit Suisse-owned Savoy Hotel Baur en Ville, which is worth more than $400m and is now part of UBS. Even Frank Quattrone wasn’t given a luxury hotel in his First Boston days!

I used to love the sole meunière at the Savoy Hotel Baur en Ville. I stayed there so many times, once when I left a pair of boxers behind, they were laundered and presented back to me in a package labelled 'Unterhose' when I next checked in.

Remember when First Boston profited from the Nazi war effort, stole their victims' money, lied about it, then got caught, and then got caught lying about it again? And again? Oh wait, sorry, that was Credit Suisse, not the investment bank. Bulgarian cocaine dealers were just the tip of the iceberg - just a sleazy corporate culture. Great stuff Rupak.