From Founder Mode to Banker Mode

Revolut expands secondary share sales to $1bn and founder outlines big ambition

Founder Mode delivers at Revolut

Brian Chesky and Paul Graham recently set the Internet alight with their description of “Founder Mode,” where founder CEOs remain extremely hands-on even after a firm has become large. These founders are not just CEOs but also chief product officers, have a flat management structure where dozens of managers report to them and they are involved in everything the company is doing. Essentially the company moves as fast as the founder can and the founder doesn’t delegate to his management team. There is a very clear strategic vision but constant iteration and not rigid 3-year plans. This is the way the likes of Steve Jobs and Jensen Huang have worked.

Listen to Nik Storonsky at Slush and he sounded very similar. The flat management structure of “founder mode” means that Huang has 60 direct reports. Storonsky also has a huge number of almost 50 direct reports albeit unlike Huang he does not just group and product meetings but one-on-ones with his leaders. Storonsky is the chief product architect and is involved in all details.

For all the noise in recent years surrounding management churn at Revolut and their inability to integrate the “grown-ups” in the room, Nik said at Slush that he had followed external advice and hired experienced managers, but they had failed to deliver and he with the assistance of his young central team of troubleshooters (ex-investment banker/consulting types) were forced to take on these responsibilities. To give context Revolut had attracted grown-ups, but I can’t think of anyone with a really big reputation even in their niche being one of those grown-ups.

The thing with “founder mode” and “manager mode" is that they are cool terms for venture capitalists, founders, and social media bloggers to talk about but the reality is always blurred. I worked for a founder CEO who built a multi-billion-dollar revenue business and sold it for $8 billion and he believed in delegating and not micro-managing his Generals when they were on the battlefield. Moreover, “founder mode” is full of survivorship bias – there are dozens of Forbes 30 under 30 type founders that did more damage than good under the guise of “founder mode”.

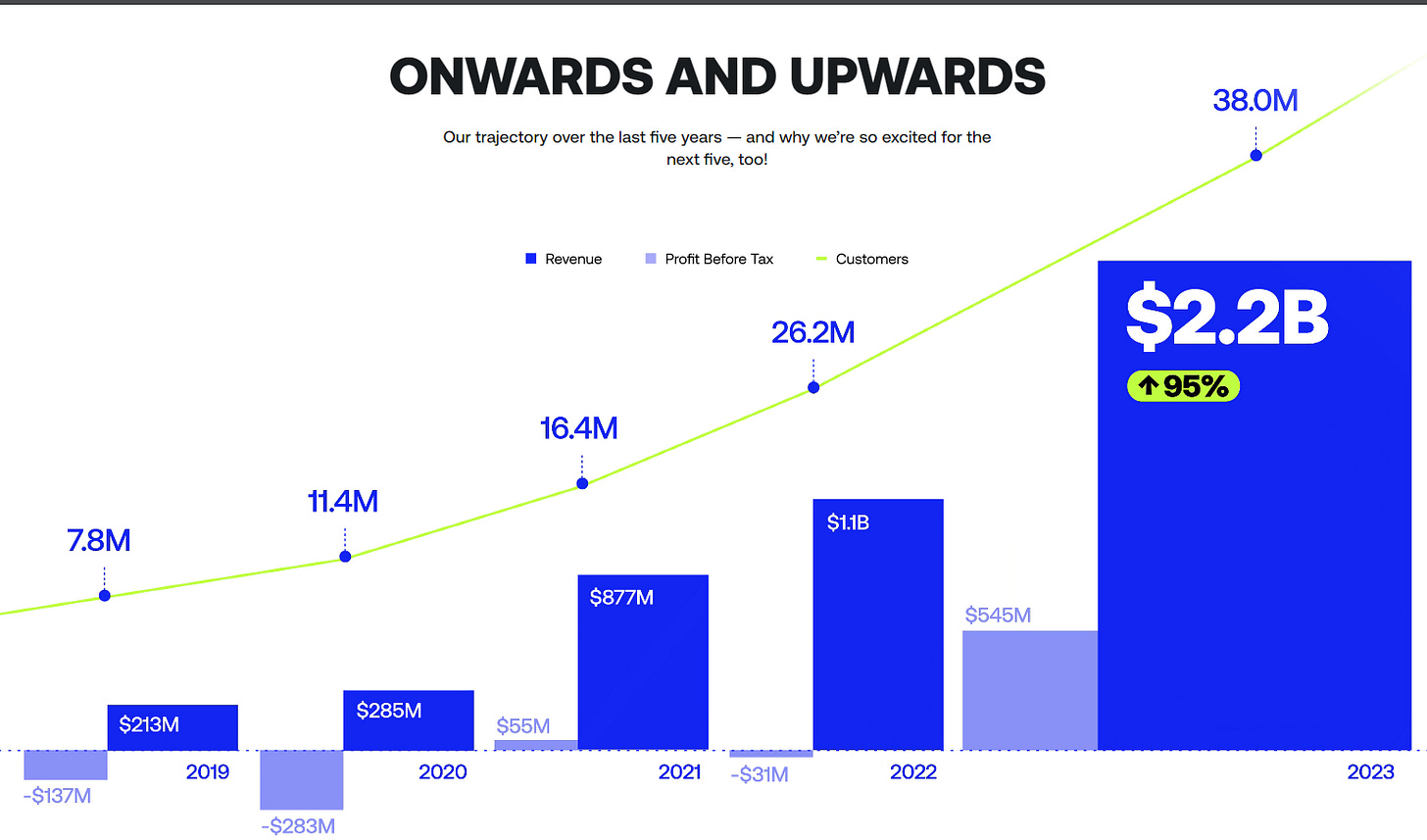

If anyone doubts whether “founder mode” worked in Revolut’s scaling phase the results speak for themselves. Revolut’s growth is truly outstanding and so far ahead of its peer group. Revenues have increased more than 10x return in only four years. The company went from a loss of £108 million in 2019 to profits before tax of £438 million in 2023.

Nik is a fan of Ray Dalio’s Principles. Not so much the polished book but the original PDF of Principles – raw and uncut before the fuzzy PR and corporate people got involved. This admiration for Dalio’s Principles is not surprising. Both Nik and Ray are data-driven. Just as Dalio is famous for his radical transparency, Nik’s mantra of Never Settle was known for many years to have led the Revolut culture to be a merciless, clinical, and fast-paced one. Of course, Dalio is alleged to have skewed Principles with his personal bias, even if the data didn’t support this. Does Nik do the same? No one knows but given his incredible track record, he has earned the right to run it as he wants. Except for his co-founder CTO Vladyslav Yatsenko, who owns a materially smaller shareholding the top levels of the firm have changed a lot over the decade.

Revolut goes global and hits 50 million customers

The company hit 50 million customers a few weeks ago and in each of the last 2 years has added 12 million customers, an impressive growth rate. The original UK market was only 29% of revenues in 2023 and is currently 20% of the customer base. Revolut’s UK user base is in line with Monzo and multiples of the 4 million users for Starling. The latter are of course deeper in business banking. These statistics compare with 20 million customers for Barclays UK retail banking, 20 million customers for NatWest Group, and 30 million customers for Lloyds Bank Group (LBG).

The rest of Europe has been powering growth for Revolut. Continental Europe contributed 64% of revenues last year and similarly the vast bulk of users. Unlike its peers and going against the mantra that retail banking is a local business model, Revolut has aggressively expanded across most countries in Europe. In France, it is the fastest-growing banking app with 4 million customers. Revolut has a similar number of customers in Romania, Poland, Spain and Ireland.

Revolut’s deposit base was £18.2 billion at the end of 2023 (half of this was from Continental Europe) which compared with £11 billion each for Monzo and Starling. The advantage for Revolut of having lots of customers with very small amounts deposited with them has been that they haven’t had to pass much of it back to their customers. Only 9% of 2023 interest income was passed back to Revolut depositors in 2023 (19% in the prior year 2022) much less than the 34% at Monzo. Why would you care about the interest you earned in a bank account with a few hundred euros relative to one with thousands in it?

The gold standard for the neobank industry Nubank has 110m users mostly in Brazil but is expanding across Latin America. Mexico is the largest of these new markets. The difference between Revolut and Nubank is that the latter is the primary bank for 60% of its clients. Nubank started out serving the unbanked market in Brazil and expanded upwards and credit and lending have been in its DNA from the start.

Revolut has struggled in the US and Nik highlighted the need to get a banking license given the US is a more credit card-driven market than Europe.

2024 milestones and 2025 outlook

As well as the strong customer growth, Revolut recently announced that given investor demand it is increasing the size of its secondary offering of Revolut shares. The first round in the summer of $500 million allowed share sales only by current employees. This second round of another $300-500 million of share sales by early investors this time, brings the total amount of 2023 secondaries to almost $1bn at a valuation of $45bn.

The 2024 revenue growth at Revolut is looking stellar. In the first half of the year, revenues grew at more than 80% year-on-year albeit as interest rates peaked in the middle of 2023 the second half comparable in 2024 is tougher. Nevertheless, it is easy to see Revolut hit revenues of $3.5 billion for 2024 and that operational leverage will drive profits to around $1 billion.

There is a lot of excitement given the growth trajectory and finally getting a UK banking license mechanically adds revenues as Revolut can now park cash at the Bank of England at slightly higher interest rates. Revolut’s big crypto footprint will benefit from surging Bitcoin prices in 2024 as well.

But here’s the thing. As interest rates start to fall further in the EU and UK in 2025 much of the more than £400 million increase in interest income will be given back. In 2023 Revolut’s client deposits increased 50% but its gross interest income rose by sixfold. Note that neobanks like Nubank and Revolut book gross interest income as revenues while traditional banks book net interest income as revenues (net of what they give back to us). For Revolut this makes a limited difference given it pays out so little at least itself. It does offer third-party money market funds with attractive yields but that is off-balance sheet and not passing through the P&L.

Revolut needs to pivot from user growth to deposit growth

What Revolut has built, and the intense hustle of its parent Nik Storonsky is truly amazing. But if I was a big Revolut shareholder I would gently be guiding Nik away from too much more geographical expansion and into going much deeper with the 50 million customers they already have. The skills in credit and treasury management are different and Revolut will need to build up its expertise.

During the dot com bubble around 25 years ago, I worked on Internet-related IPOs, and it was all about subscriber growth. That was the key metric that everyone – investors, founders, and media – cared about. The subsequent dot com bust was all about cash burn and the route to profitability.

Revolut is not just a subscriber story, and revenues and earnings momentum has started to come through impressively as I highlighted earlier. It was originally started in 2015 as an app to allow cheap FX transfers but in 2023 it only made 17% of its revenues from FX. The biggest revenue source is interchange from the use of its debit cards and interest income is also significant now. But Revolut has two and a half times as many customers as Barclays UK and the latter generates around three times as much revenue mostly from retail banking but also business banking and credit cards. The gold standard of extracting supernormal rents is JP Morgan Chase and its 82 million retail and 6 million SME banking clients generated around $70 billion of revenues in 2023 illustrating the potential when you go deeper.

Nik Storonsky said at Slush that his ambition is 100 million customers and revenues of 100 billion. It was a great headline for the media!

Customer is king

I first got a Revolut account about 6 years ago as I was fed up with being ripped off by the UK high street banks on FX rates when I went on holiday. If you look today Revolut and Wise typically offer the best value for FX transfers from the UK albeit my choice of Revolut was not an analytical one but just a random choice. I have relied on Revolut ever since for FX. Occasionally I use Revolut as my debit card on my iPhone wallet, but I probably use my other bank accounts more.

When I was at university in the late nineties, I got a bank account with a major UK High Street bank and have been with them ever since including for mortgages. When the Global Financial Crisis happened, I wanted deposit diversification and started to use a 2nd of the big UK High Street banks. When UK interest rates rose recently but UK banks were slow to pass this on to their current account or instant access savings accounts, I phoned up those UK banks to complain. The guy in the UK bank call centre wasn’t exactly an “Always be closing” Glengarry Glen Ross salesman and told me he had opened a Chase account where savings rates were the best. Chase seemed like a safe bank. Jamie Dimon is well Jamie Dimon. There is the deposit insurance but if JP Morgan Chase is going to have a deposit run, we might as well go back to living in caves. What surprised me is how easy the account set-up was and I have been happy with Chase ever since.

Revolut has a great following with its customers, and it will be interesting to see now that it has a banking license how it does in the UK regulator’s surveys of consumer bank customer satisfaction. Monzo CEO TS Anil is always first to highlight that they may not have the splashy headlines like Revolut but in the UK they are just as big and competitive. In this year’s survey, Monzo was first, followed by Starling, and then Chase in third place.

One area that will require significant investment in a post-banking license era is fraud detection. A few months ago, the UK Ombudsman released data that Revolut had more fraud complaints than any of the giant UK High Street banks with a material increase in the second half of 2023.

Revolut has always wanted to be seen as a tech firm. Moving fast and breaking things. Hiring from the likes of Amazon. But banking regulation works with a lag. Financial institutions rarely get into trouble at the point something happens. They usually get fined and reprimanded 5 years later. Starling’s recent £29m fine from the FCA who said, “Starling’s financial sanction screening controls were shockingly lax,” serves as a warning here.

Building a Superapp?

Nik Storonsky had a vision of Revolut being a Superapp. I once explained to his colleagues how different the app landscape was in the West relative to the likes of China. They didn’t have an explanation for how Revolut would be a Superapp. There are new analytical tools and smoother user interfaces and I am sure lots of deals beyond the FT subscription and cinema tickets but how much time do you spend on the Revolut app?

Perhaps I am just a boomer and the core Revolut user base under 35 spends more of their time on the Revolut app but if they do so why do they not park any cash beyond idle change in their Revolut account?

This is of course why Nik and Revolut chased the UK banking license so hard. Nik Storonsky is refreshingly candid that it was a mistake trying to be regulatory light and not being able to offer a deep product suite in many markets. Not only does Revolut have a banking license now in the UK allowing it to offer credit products but a few days ago it got a UK trading license and is now authorized as an investment firm. This means material improvements in the user experience and product offering of Revolut’s 650,000 existing UK trading customers. Previously they could only trade US stocks and the new license allows Revolut UK users access to UK and European stocks as well as ETFs.

However, is it just a matter of a banking license? Revolut may have taken Continental Europe by storm but its average deposit sizes in these markets where it is regulated as a bank and benefits from the deposit insurance protection of up to €100,000 is woeful. It has also been under ECB supervision more recently. Having a banking license allows Revolut to offer credit-related products but the fact that average deposit sizes in Continental Europe are much lower than the UK was before the banking license makes you wonder about its impact on deposit sizes. The reality is that deposit sizes will be a slow burn. It is a broad trust issue as per my personal story earlier.

Banking is a trust business.

2 other KPIs Revolut should be pivoting to are the proportion of subscription revenues and number of products customers are using and time spent on their app. The former is crucial for a valuation in an IPO. The latter is crucial for Revolut’s moat and ancillary opportunities like advertising. There is a reason Amazon can build a monster advertising business like the social media giants and this simply is that we all use these platforms a lot.

It's hard to switch to "Banker Mode" and stay cool, but maybe as the "kids" grow their savings and deposit size, they care less about cool?

Glengarry Glen Ross 🤣 👊