Is Chase UK the new bank for boomers like me?

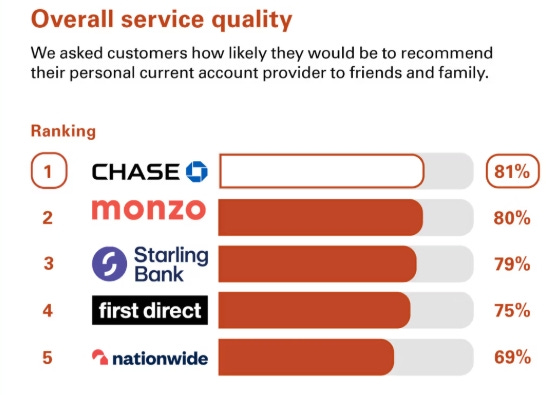

An old-school bank is beating cool fintech neobanks on customer service. This week Chase UK has come number one in the latest Ipsos (FCA-mandated) survey of UK retail banking. I wrote about the success of Chase in the earlier long pieces on UK banks and fintech. In the prior survey 6 months ago Chase UK came third behind Monzo and Starling for overall service quality. Note that Revolut was not in these surveys as it only recently got its UK banking license.

Why is Chase UK able to compete?

Size of investment

Recently closed cross-border payments app Zing may have cost HSBC $150m but Chase UK has been an even bigger investment for JP Morgan. The bank has invested around $1bn into the business. In the first year after its launch in September 2021, Chase UK lost $450m. Big numbers for anyone but JP Morgan. It expects Chase UK to hit breakeven in 2025.

This kind of investment has gone largely unnoticed by JP Morgan shareholders because of the scale of the whole bank and the huge earnings power that Chase has delivered in its home market. Chase is the dominant player in US retail banking and has benefited from rising interest rates, the flight to quality after Silicon Valley Bank, and customer inertia at big banks. In the US it has 82 million retail customers and 6 million SME customers, and it generates $70 billion of net revenues from these customers at a best-in-class 32% return on equity.

Consequently, there is very little shareholder pressure on the Chase UK investment. That would have been very different for the likes of Barclays or Citigroup if they had just sunk $1 billion into a new retail bank. The bottom line is that JP Morgan understood the scale of the commitment required and it has been an expensive product launch.

But you can bet the Chase UK team is feeling the pressure from Jamie Dimon. In the style of legendary Sir Alex Ferguson giving his winning Manchester United football team dressing room rants that became famously known as “The Hairdryer Treatment”, Jamie Dimon is never shy to push his team! In recent days a leaked recording of his raging against the work-from-home culture at an internal town hall went viral. Despite their incredible record levels of profitability JP Morgan has also started to trim headcount reflecting their proactive management.

Give customers something

The Chase team got the basics right. They built the business separately with technology from cloud and micro-services driven vendor 10x (founded and run by former Barclays CEO Antony Jenkins) rather than their legacy systems.

As a happy customer, I was impressed by the speed and ease of the onboarding and clean user interface. This was just as good as the best of the UK fintech neobanks!

Chase UK has also been wise with a loss-leader strategy of offering larger financial incentives at launch and gradually reducing them to be more in line with competitors. For instance, its cashback offering has over time looked more like peers with the amount that you need to pay in and spend every month rising from £500 to £1,500 and the 1% cashback being capped at £15 per month. Similarly, I was particularly attracted to Chase UK at launch because of the 5% interest rate it offered me on instant access savings, which was far superior to equivalent offerings from the likes of Barclays. Alas, they have steadily cut this at a faster pace than competing offerings. The interest rate on this is 3.25% now.

Of course, disruption works easier in new markets. Chase has nothing to lose in the UK where it has no legacy business. The market structure of the US, which is a credit card-driven market with huge related scale advantages is very different.

The JP Morgan Fortress

Chase UK is likely to have an older and more affluent customer base than the likes of Monzo, Revolut, and Starling. These people have more money and probably fewer mobile banking apps. Hence Chase UK’s customer base of 2.5 million isn’t directly comparable to the circa 10 million that Monzo and Revolut have in the UK or the 4 million that Starling has.

But there is one major competitive advantage of being a smart well-respected incumbent, that all of the Innovators Dilemma crowd typically forget.

Trust.

And in banking trust matters. Trust in the quality of service gets a lot of attention and rightly so if you compare the performance of some of the large UK legacy banks. But there is also trust in safety. Given the safety provided by the deposit insurance schemes in the UK and EU, why are customers who are very happy with the service of neobanks not willing to leave large amounts of their money in a neobank? I know many people who are happy leaving tens of thousands of pounds in Chase UK but wouldn’t leave more than £500 in a fintech neobank!

Although it has not seen the same viral customer growth and international expansion as Revolut, Monzo and its CEO TS Anil pride themselves on the depth of their customer relationships in the UK. As it has grown and also expanded with SMEs, the average deposit size has risen threefold over the last five years. The chart below shows how Monzo’s average deposit base is a multiple of Revolut’s global numbers albeit the gap is smaller when looking at Revolut’s UK customer base alone. But the more interesting comparison is with traditional banks.

UK market leader Lloyds Banking Group (LBG) has a retail deposit base that is 30x larger than Monzo and an average deposit size in its retail bank of more than £11,000, which is around 10x larger than Monzo. Even SME corporate-focused Starling has a much lower average deposit size than Lloyds Bank.

The only new startup bank to come anywhere near to leading incumbents in the UK is Chase UK with an average deposit size of over £8,000.

A key catalyst for Chase UK will be the upcoming increase in the primary deposit threshold for ringfenced banks from £25bn to £35bn. Creating a ringfenced UK bank is costly and reduces the synergies that Chase UK could extract from being part of the world’s biggest and strongest bank. Chase UK has more than £20bn of deposits currently, just shy of Goldman Sachs’ Marcus high net worth offering and below the £25bn cap.

Chase UK launched in September 2021, attracting £8bn of deposits within the first 9 months. In its first two years, Chase UK was able to attract as much in deposits as Revolut and Monzo took almost a decade to get. The growth of deposits at Chase UK has slowed in recent quarters but you wonder how much of this is strategic and waiting for the deposit threshold to be raised. There is always a short-term financial cost of incentives to attract deposits quickly but if anyone has deep enough pockets to do this it is JP Morgan.

Monzo worries about Revolut. The big 5 UK banks worry about competition from Monzo, Revolut, and Starling. Are they all missing the wood from the trees?

JP Morgan has had its fair share of failures in fintech. One of the biggest of these mistakes the acquisition of Viva Wallet is heading for court in Greece. Another of these, a $175m purchase of the student loan startup Frank is heading to court this week in the US. Frank founder Charlie Javice is alleged to have paid a data scientist to add millions of fake users to Frank's user numbers ahead of their sale to JP Morgan.

But if there is one thing that is clear about the track record of JP Morgan under Jamie Dimon it is that when they have the wind at their back they know how to take advantage and when they smell blood in the water they pounce. Just look at how they won in the GFC and became a market leader in FX trading, equity trading, payments, and investment banking.